2026/01/26 | Diego Ciongo & Soledad Castagna

At today's monetary policy meeting, the central bank’s Monetary Policy Committee (MPC) cut the policy rate by 100-bps to 6.50%, entering in an expansionary stance. The communiqué does not mention if the decision was unanimous or divided. The easing cycle has accumulated 275 bps since July. Last Friday, the BCU announced the rescheduling of its MPC meeting from February 12 to today, citing changes in the global environment that could affect inflation dynamics in Uruguay.

The BCU’s decision was made in light of projected inflation misalignment relative to the target, with the aim of ensuring that monetary conditions support a resumption of convergence toward the 4.5% annual target.

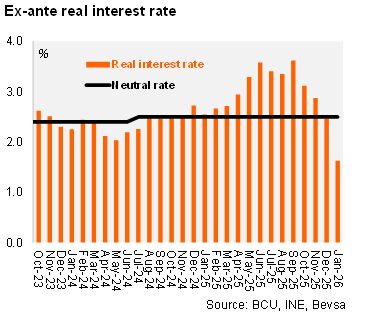

Entering an expansionary stance. CPI inflation ended at 3.65% in 2025, while inflation expectations continue to fall. Average inflation expectations for the monetary policy horizon (24 months) stand at 4.79% (down from 4.92% in the previous meeting), within the tolerance range for the eighth consecutive month. Consequently, we estimate the ex-ante real policy rate at 1.63%, below the BCU’s neutral real rate estimate of 2.5%.

An eye on the exchange rate market. The BCU highlighted the weakening of the USD in the global market. This situation has been amplified domestically in recent weeks due to a more sensitive foreign exchange market.

Data dependent mode. The BCU mentioned that if extraordinary domestic circumstances arise again, this decision will be accompanied by the use of other instruments aimed at keeping inflation within the tolerance range and returning to convergence towards 4.5% inflation target. In addition, the central bank does not rule out adopting a more expansionary monetary policy stance in the coming meetings.

Our take: Our terminal rate forecast stands at 6.50%, assuming that inflation and inflation expectations will converge toward the target. Nevertheless, we cannot rule out further cuts or measures ahead, depending on the performance of UYU, inflation and activity. Additionally, the BCU has announced an extra meeting in March, although a specific date has not yet been set (this will be the next meeting). This is because the next scheduled meeting, on April 21, is too far away in light of the recent calendar change. The minutes of today’s meeting will be published on January 29.