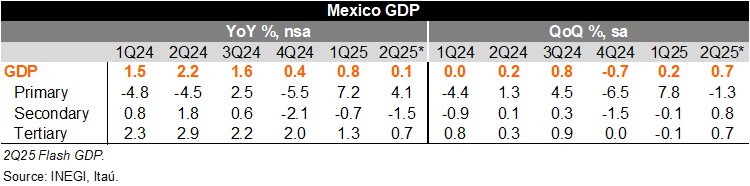

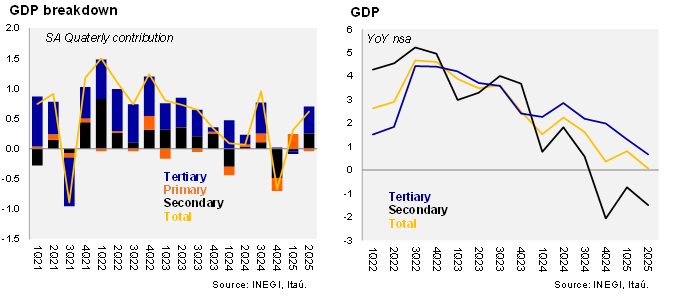

The 2Q25 flash GDP rose by 0.1% YoY, aligning with Bloomberg’s market consensus but above our forecast -0.2% YoY. On an annual basis, activity decelerated with respect to 1Q25 (+0.8% YoY). Primary activities increased by 4.1%, industry declined by 1.5%, and services grew by 0.7% on an annual basis. 2Q25 data was affected by different Easter holiday dates compared to 2024 (2Q25 vs.1Q24). Using seasonally adjusted figures, GDP rose by 0.7% QoQ (Bloomberg 0.4%, Itaú 0.5%), driven by the performance of services at 0.7% and industry at 0.8%, despite a contraction in agriculture by 1.3%. With these seasonally adjusted results, 1H25 GDP grew by 0.9% compared to 1H24.

Considering that the observed monthly GDP averaged a contraction of 1.0% YoY in April-May, today’s estimate implies that June was close to +2.1% YoY. Our calculations suggest a 0.78% monthly growth (up from +0.0% in May), which is above INEGI’s nowcast of 0.2%. The final GDP release is scheduled for August 22. Given the historical revision in trade data (see here), GDP is likely to be adjusted later, probably on September 19, with the release of aggregate supply and demand figures. Based on our calculations, this adjustment will imply a revision of the 2024 GDP to 1.5% YoY, up from 1.4%, and a downward revision for 1Q25 to 0.7% YoY from 0.8%, which would give a lower base effect for the second quarter.

Our take: Today’s release suggests that activity has been resilient, so far, with a statistical carry-over for 2025 at 0.8%. Looking ahead, we anticipate some support from international sources of Mexico’s growth, primarily in manufacturing exports still with some frontloading effects, and growth in the tourism sector. The outlook for domestically related sectors is mixed, however, with a moderation in local services and a contraction in investment. The government is focused on strengthening the domestic market amid changes in the global outlook, which might be a modest driver for growth going forward. We maintain our GDP forecast of an expansion of 0.2% YoY in 2025, with a positive bias. Regarding monetary policy, a more resilient economy seems consistent with Banxico’s hawkish communication, favoring a 25-bps cut in the next meeting (August 7) to 7.75%.

See detailed data below