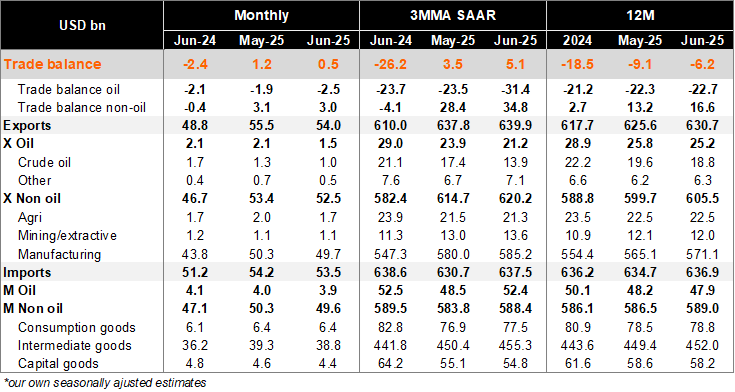

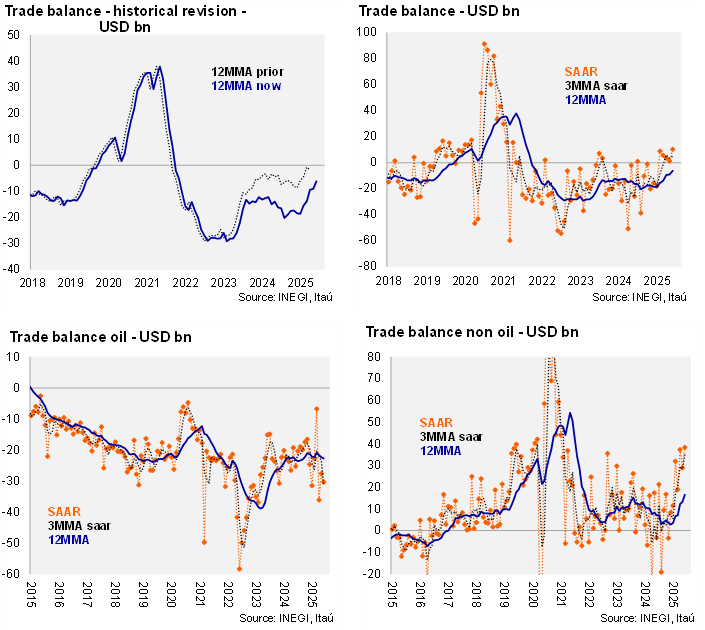

June’s trade balance revealed a USD 514 million surplus, below Bloomberg’s market consensus of a USD 950 million surplus but significantly above June 24’ deficit of USD 2.4 bn. On a 12-month rolling basis, the trade deficit reached USD 6.2 bn, improving from a USD 9.1 bn deficit in May. Most importantly, today’s release incorporates a significant historical revision of the data (link). Within the framework of the Specialized Technical Committee on Foreign Trade Statistics (CTE-ECE), comprised of INEGI, the Bank of Mexico, the Ministry of Economy, and the Tax Administration Service, adjustments were made to foreign trade figures for various periods as a result of the review process of published information. The main revisions were to data on petroleum product imports (between January 2022 and May 2025), crude oil export figures (between January 2022 and May 2025), and agricultural goods export data (between April 2024 and May 2025). In the case of petroleum product imports, the statistical revisions reflected extraordinary modifications to historical customs clearance documents based on the "Law of the State-Owned Enterprise, Petróleos Mexicanos," published in the Official Gazette of the Federation on March 18, 2025. With this revision, the 2024 goods trade deficit was revised from USD 8.2 bn to USD 18.5 bn (see graph below).

At the margin, using three-month annualized seasonally adjusted figures, the trade balance shifted to a surplus of USD 5.1 billion (up from a USD 3.5 billion surplus in May). Examining the breakdown on a 12-month rolling basis, the oil trade balance continued to show a deficit (USD 22.7 billion deficit compared to a USD 16.6 billion surplus for non-oil), following the decline in domestic oil production and the government's strategy to prioritize domestic oil refineries.

Our view: The highlight of today’s report was the historical data revision, which revealed a significantly worse trade balance deficit since 2023. However, data at the margin continues to improve, albeit from a worse starting point. The uncertainty surrounding Mexico’s trade relationship with the US will continue to challenge trade flows until a definitive USMCA renegotiation begins. Looking ahead, oil exports will be influenced by domestic policies related to national sovereignty and oil price dynamics. Weaker internal demand and a slowdown in construction are likely to limit non-energy consumption and capital imports, particularly for non-residential projects.

See detailed data below