According to the Budget Office’s data, short-term fiscal dynamics gradually improved in 1Q25, although critically low levels of liquid assets are a source of concern.

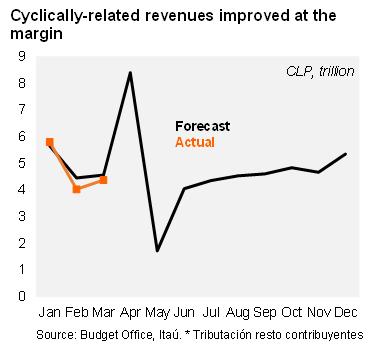

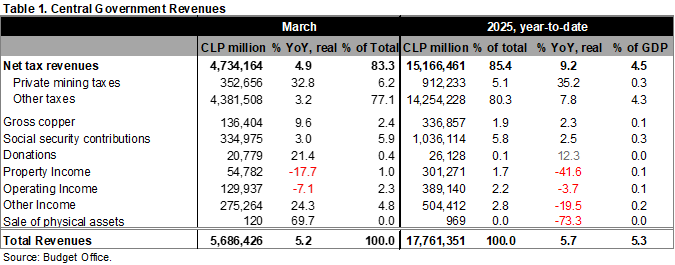

Solid revenue growth in 1Q25, but still our estimates. Real revenues rose by 5.2% YoY in March, closing a 5.7% YoY growth in the quarter. Revenue growth in the month was (again) mainly driven by cyclical factors, but mining seems to be playing a more important role at the margin (also base effects due to the implementation of the revised royalty law, see Table 1). Despite the improvement, cyclically-related revenues (tributación resto contribuyentes) are somewhat below our forecasts. As such, real revenues accumulated in the year through March increased by 5.7%, below the MoF’s annual 9.0% forecast.

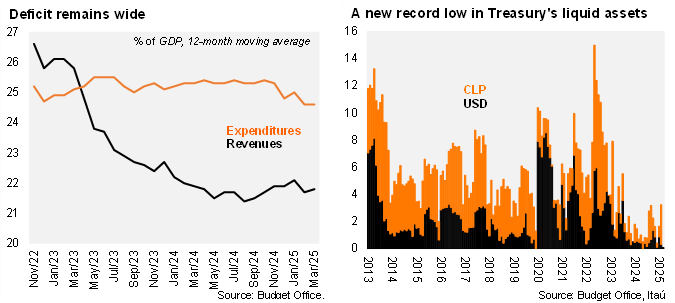

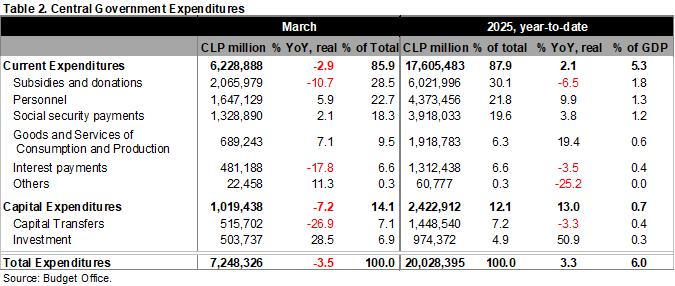

Base effects led to an unexpected (but welcome) spending contraction in March. Real spending fell by 3.5% YoY in March, leading to total spending growth in the quarter of 3.3% YoY. Current expenditure in March fell by 2.9%, mainly driven by base effects (differences in educational subsidies and timing of interest payments). Still, current expenditure rose by 2.1% YoY in the quarter, accumulating 25.4% of the annual budget, in line with last year. Capital expenditures fell by 7.2% YoY in March, mainly due to lower capital transfers, leading to a 13% YoY increase in 1Q25. Capital expenditures reach 18.3% of the annual budget through March, well above the previous two years (16.9% in 2024, 13.0% in 2023). The MoF appears to be frontloading spending in capital expenditure again. Spending will have to slow further in the year if the MoF plans on achieving its annual spending forecast of 2.3%.

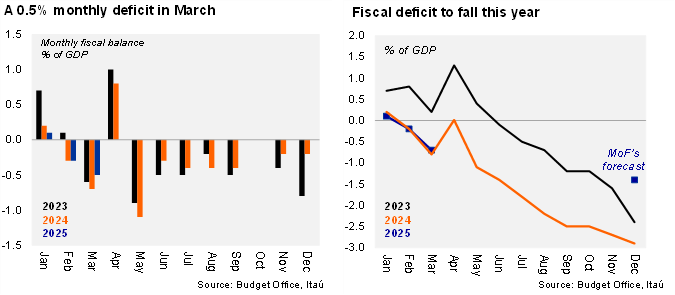

Even though real revenue growth accelerated further in March and spending contracted, March’s monthly fiscal deficit still reached 0.5% of GDP, but moderated from March 2024 (0.7% of GDP). The fiscal balance through 1Q25 reached a deficit of 0.7% of GDP, same as in 2024.

The 12-month rolling fiscal deficit fell to 2.7% of GDP in March, from 2.9% of GDP in February. On a 12-month moving average basis as of the end of March, the central government’s revenues reached 21.8% of GDP, and expenditures 24.6% of GDP, leading to a cumulative deficit of 2.7% of GDP, improving from the 3.4% of GDP from a year earlier.

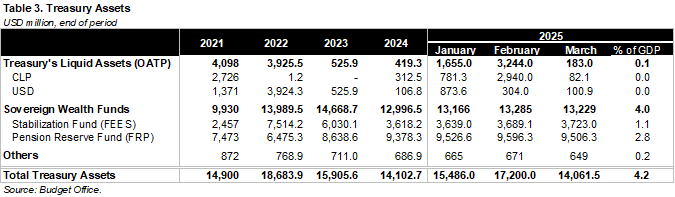

No hay plata … liquid assets at the Treasury fall to the lowest level on record since at least 2007. Liquid assets in the Treasury (Otros Activos del Tesoro Público) fell to a mere USD183 million in March, down from roughly USD3.2 billion in February, the lowest level on record since 2007. The steep decline in the month reflects deficit financing, sizable local currency amortizations, and potentially below-the-line transfers. AUM in the sovereign wealth funds were little changed, likely reflecting valuation effects. The Stabilization Fund (FEES) reached USD3.7 billion, and the Pension Reserve Fund (FRP) was down slightly to USD9.5 billion.

Small amounts of dollar sales from the MoF are likely in May. As we anticipated last month (here), the MoF did not sell dollars in April, underperforming the guidance (up to USD300 million per week through June). For May, we believe the MoF could sell up to USD500 million. The MoF has sold a total of USD2.4 billion in the year through April, above the USD1.9 billion in the same period in 2024. We envisage 2025 annual dollar sales at about USD8.4 billion (USD6.9 billion in 2024). Importantly, dollar sales finance the government’s fiscal needs (primarily in pesos), disregarding exchange rate considerations, consistent with Chile’s free-floating exchange rate regime.

Our take: Data through 1Q25 reveal an expected improvement in revenues and some signs of spending restraint. This year’s fiscal consolidation forecast rests on additional spending restraint and continued revenue improvement; now, all eyes are on April’s projected revenue jump. We still believe that the recently announced watered down structural deficit target seems challenging (see our note on the recent Public Finance Report here). The MoF forecasts this year’s spending growth at 2.3% (3.3% as of 1Q25), significantly below previous election years. We forecast a nominal deficit of 2.2% of GDP this year. Low liquid assets should lead the MoF to continue with their debt-financing plan, even though the official forecasts consider a somewhat smaller nominal deficit. The Budget Office will release April’s fiscal data on May 30.