The Budget Office recently published the 1Q25 Public Finance Report containing the final fiscal data for 2024 (following the publication of last year’s National Accounts by the BCCh), and minor revisions to macro-fiscal forecasts, among others. On the former, last year’s nominal deficit was revised down by 10bps to 2.8% of GDP, while the structural deficit was revised slightly up to 3.3% of GDP (3.2% with preliminary data), leading to an even greater miss with respect to last year’s structural deficit target (1.9% of GDP).

A raincheck on major macro forecast revisions. The MoF decided to postpone major revisions to the macro outlook, considering elevated global policy uncertainty. The 2025 GDP growth forecast remained at 2.5% (BCCh analyst median forecast at 2.0%), the year’s average CPI was revised down to 4.4% (from 4.7%), and exchange rate average was strengthened slightly to 979 (from 992). The copper and oil (WTI) price forecasts remained unchanged at USD4.26 per pound and USD71 per barrel, respectively.

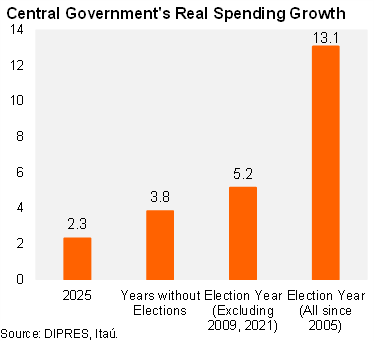

2025 nominal deficit forecast revised down, mainly driven by spending cuts. This year’s nominal deficit forecast was revised down from 1.7% of GDP to 1.4%, due to expenditure cuts of roughly 0.58% of GDP. Including these measures, real expenditures are projected to rise by 2.3%, well below the average spending growth since 2000 (3.8%), and the average of election years since 2000 excluding crisis years (5.2%). Revenue forecasts were revised down by 1% with respect to the previous forecast.

A watered-down structural deficit target. As mentioned earlier, last year’s structural deficit target was revised higher to 3.3% of GDP, well above the target of 1.9% of GDP. As we anticipated over the past several months, this year’s structural deficit target was watered down to a deficit of 1.7% of GDP, above the 1.1% target, pointing to the second consecutive annual fiscal miss based on the administration’s original fiscal targets. The fiscal impulse, as measured by the annual change in the MoF’s primary structural deficit forecast reaches -1.4% of GDP (2024: 2.3 % of GDP, 2025 0.9% of GDP).

Our take: Complying with this year’s watered-down target implies a significant negative fiscal impulse (1.4% of GDP). If met, ceteris paribus, we believe the BCCh has slightly more room to cut. However, risks tilt towards a slower fiscal consolidation and a less negative impulse in the context of an election year. Importantly, in our view, the revisions in the Public Finance Report do not change our view on the MoF’s financing needs for this year – with a gross debt financing plan of USD16 billion. The Budget Office will publish fiscal data through March on April 30 and the next Public Finance Report is scheduled for July 14.