April is a key month in Chile’s fiscal dynamics, considering that revenues jump on the back of the Annual Tax Season. In this context, revenues continued to improve, primarily driven by a greater than expected contribution of mining.

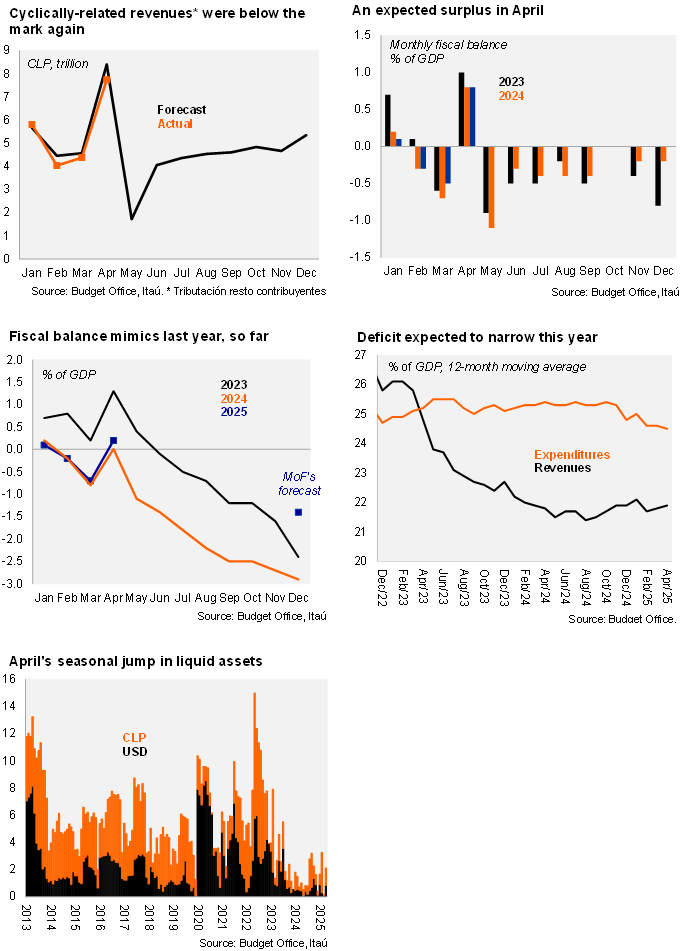

The Central Government’s real revenues jumped by 8.0% YoY in April, building on the 5.2% of March, with differing dynamics beneath the headline. Cyclically-related real revenues (tributación resto contribuyentes, comprising roughly 80% of total revenues) slipped at the margin (-2.2% YoY), the first annual contraction in the year. This component has been below our forecast for the third consecutive month, accumulating a 0.3% of GDP shortfall in revenues (see chart). In contrast, mining-related revenue sky-rocketed, reflecting the first full-year of the new mining royalty law, elevated copper prices, and greater copper production. Large private mining firms paid royalties for a total of roughly USD1.9 billion, leading to a jump in private mining revenue in the month of 343.5% YoY. Property rents, primarily related to lithium payments, fell by 39.5% YoY. Despite the boom in mining-related payments, total real revenues accumulated in the year through April have increased by 6.4% YoY, below the MoF’s annual 9.0% forecast.

Spending frontloading continues as expenditures bounced back in April, partly driven by base effects. Real spending rose by 4.1% YoY, with current expenditure increasing by 2.8% and capital expenditure by 13.7%. Regarding the former, spending on personnel rose by 9.2% YoY and interest payments did so by 72.5% (driven by base effects), while subsidies and donations fell by 1.4% due to base effects. Current expenditure has increased by 2.8% YoY through April, accumulating 34% of the annual budget, slightly above the previous two years. Capital expenditures increased by 15.5% YoY in April, mainly due to an increase in capital transfers. Capital expenditure rose by 13.7% YoY through April, taking this component’s expenditure to 26.5% of the annual budget, well above the previous two years (24.0% in 2024, 19.7% in 2023). The MoF appears to be frontloading spending in capital expenditure again. After rising by 4.1% YoY through April, expenditure will have to slow further in the year if the MoF plans on achieving its annual spending forecast of 2.3%.

As is usually the case, April’s fiscal balance ended with a surplus, this time of 0.8% of GDP, same as in April 2024. The cumulative fiscal balance through April reached a surplus of 0.2% of GDP, slightly higher than the 0.01% in 2024.

The 12-month rolling fiscal deficit fell to 2.6% of GDP in April, from 2.7% of GDP in March. On a 12-month moving average basis as of the end of April, the central government’s revenues reached 21.9% of GDP, and expenditures 24.5% of GDP, leading to a cumulative deficit of 2.6% of GDP, improving from the 3.5% of GDP from a year earlier. We expect a narrowing of the deficit, primarily due to an improvement in revenues.

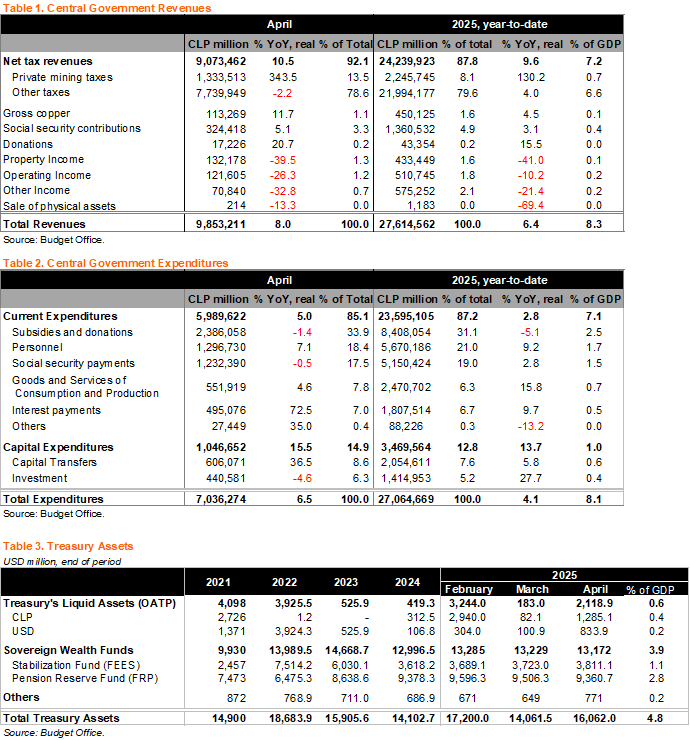

Liquid assets at the Treasury edged up in April, yet remain low from a historical perspective. After the record low liquid assets at the Treasury (Otros Activos del Tesoro Público) registered by the end of March, the sizable revenue inflows from Tax Season and debt issuances in the period, led to a welcome increase. Liquid assets in the Treasury rose USD2.1 billion in April (from a mere USD183 million in March), above April 2024’s level (USD1 billion), yet still a seasonally low balance from a historical perspective (the second lowest at least since 2011), suggesting cash buffers are likely to remain constrained in the near term. AUM in the sovereign wealth funds were little changed, likely reflecting valuation effects. The Stabilization Fund (FEES) reached USD3.8 billion, and the Pension Reserve Fund (FRP) was down slightly again, to USD9.4 billion.

The MoF is likely to sell fewer dollars in June. As we anticipated last month (here), the MoF auctioned dollars in the spot market during May, after having been absent since March 21. Dollar sales in the month began May 12 reaching a total of USD900 million, capped at the weekly guidance of up to USD300 million (through June). We had expected dollar sales to reach a maximum of USD500 million, with the larger amounts sold likely sourced from April’s greater-than-expected dollar-denominated mining revenue. Dollar sales were likely driven by the sizable deficit that takes place annually in May, consistent with tax returns following April filings. The MoF has sold a total of USD3.3 billion in the year through May, above the USD1.9 billion in the same period in 2024. We envisage 2025 annual dollar sales at about USD8.4 billion (USD6.9 billion in 2024). Considering the end-April liquid dollar-denominated balance, May’s sales, and foreign currency interest payments scheduled for July, we believe the MoF could sell up to USD400 million in June. Importantly, dollar sales finance the government’s fiscal needs (primarily in pesos), disregarding exchange rate considerations, consistent with Chile’s free-floating exchange rate regime.

Our take: Even though mining revenues saved the day in April, cumulative core revenues are below the mark, and cash levels at the Treasury remain low, suggesting the MoF’s USD16 billion debt issuance plan for this year will remain unchanged. This year’s fiscal consolidation forecast rests on additional spending restraint and continued revenue improvement; now, all eyes are on May’s projected revenue slump and the respective large monthly deficit. We still believe that the recently announced watered down structural deficit target seems challenging. We forecast a nominal deficit of 2.2% of GDP this year. The Budget Office will release May’s fiscal data on June 30. The next Public Finance Report is scheduled for July 14.