2026/01/21 | Diego Ciongo & Soledad Castagna

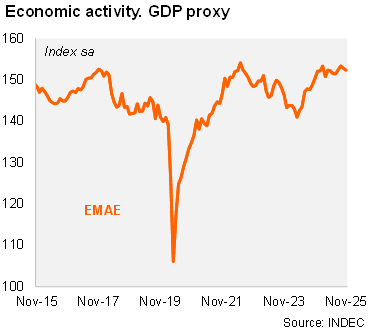

According to the EMAE (official monthly GDP proxy), activity fell by 0.3% MoM/SA in November 2025, marking the second consecutive drop. Conversely, activity increased by 0.7% qoq/sa in November, similar to the 0.8% qoq/sa in October. On an annual basis, activity fell by 0.3% in November, marking the first decline since September 2024. Thus, the statistical carryover for 2025 and 2026 stood at 4.3% and 0.2%, respectively.

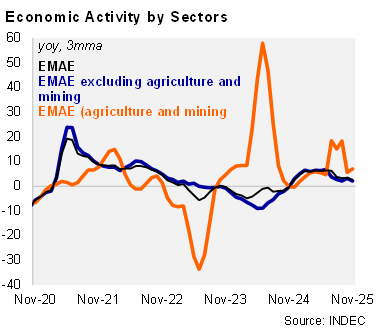

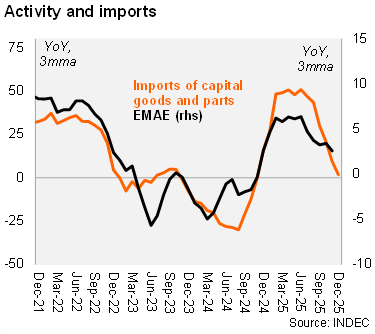

All sectors expanded on an annual basis in the quarter ended in November, except manufacturing. Primary activities rose by 7.0% YoY during this period (compared to +18.4% YoY in 3Q25), while services (including the commerce sector) expanded by 2.3% YoY (vs. 2.1% in 3Q25). Moreover, construction rose by 1.9% YoY (from -0.4% YoY in 3Q25). On the other hand, manufacturing fell by 4.0% YoY (vs. a drop of 4.6% YoY in 3Q25), in line with lower capital goods and parts imports, which also continue decelerating in December (see our report here).

Our take: Despite the weaker activity data for 4Q25, we still forecast 4.5% GDP growth for 2025. For 2026, we expect a slowdown to 3.5%, partly due to a lower carryover. The recovery of real wages and lower interest rates should support private consumption growth this year. The investment outlook also improved following the midterm election result and the pipeline of large-scale investment projects under the RIGI program. The GDP proxy for December will be published on February 24.