2025/10/27 | Diego Ciongo & Soledad Castagna

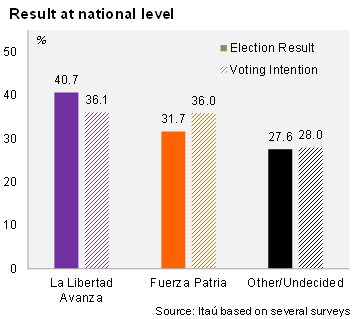

In the midterm elections, Argentina’s President emerged as the clear winner of the midterm elections. The incumbent won with a better-than-expected result at the national level, surpassing the average of several surveys. La Libertad Avanza (LLA) received 40.7% of the total national vote, followed by the Peronism (Fuerza Patria) with 31.7%.

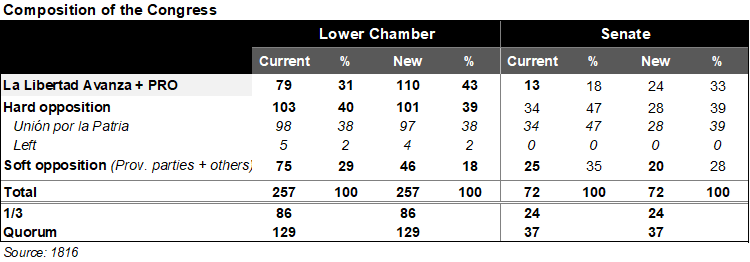

Midterm elections were held on Sunday October 26 to renew one-third of the Senate seats (24) and half of the Chamber of Deputies seats (127). All provinces elected deputies. However, only eight provinces (including Buenos Aires City) elected senators. Voter turnout was low, reaching 68%. The new Congress takes office on December 10.

The government's presence in Congress improves materially. Starting with the Senate, LLA won 12 seats and will have 18 seats by December. Notably, LLA did not have any seats at stake in this election. In net terms, Peronism lost six seats and will hold 28. The PRO party had a net loss of two seats and will have 6 in December. Moving on to the Lower House, LLA gained 44 seats, increasing from 37 to 81. The Peronism did not gain any seats in net terms and will maintain 99 seats, remaining the largest minority in both chambers. However, together with allies, LLA will have the one-third necessary in both chambers to maintain veto power.

Looking ahead, alliances are key. Since no political party has a majority in both chambers, alliances are necessary to push through an agenda. Consensus must be built with groups that share similar goals, as President Milei stated in his speech after the results were announced. So, securing votes from the so called “soft opposition” will be crucial for the government’s agenda in congress.

Once again, the result differs greatly from the average poll predictions from last week (a technical tie between LLA and Fuerza Patria).

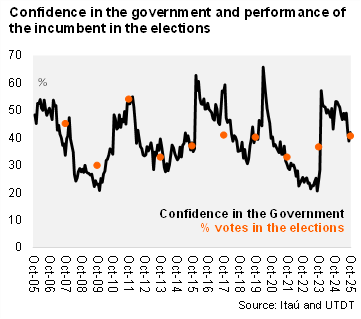

Confidence in the government was again a better predictor of the election outcome. According to the Universidad Torcuato Di Tella’s monthly survey published today, confidence in the government rose by 8.2% MoM to 42.0% in October, reversing an 8.2% drop in the previous month. Relative to the previous administrations, confidence is above Alberto Fernández (October 2021) yet below Mauricio Macri (October 2017). This recovery was recorded during the first half of October (the fieldwork was carried out between the 1st and 14th of this month), that is, on average, about 20 days before the national legislative elections on October 26.

Now that the elections are over, what happens next?

Politically, the government will likely attempt to pass the so-called "Bases" Law II. This would be the second phase, following the 2024 approval of the original "Bases" Law (see our report for more details). The “Bases” Law II would include reforms to education, the labor market, natural resource exploitation, private property, and a tax framework. Additionally, the 2026 budget bill discussion continues in Congress, with fiscal balance still the main anchor of the program.

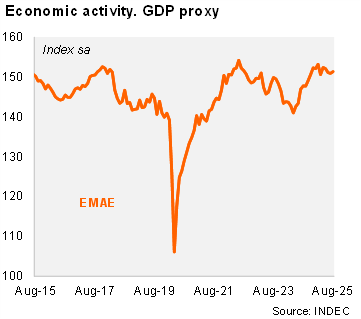

In the economic sphere, the challenges are significant. Following a robust recovery in the second half of 2024, economic activity is projected to enter a technical recession in 3Q25. Indeed, activity decreased by 0.4% in the quarter ending in August, following a 0.1% QoQ/SA, following a decline in 2Q25.

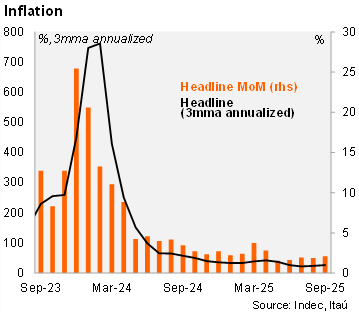

Meanwhile, inflation accelerated slightly in September. Consumer prices rose 2.1% MoM in September, up from the previous month. Inflation appears to have stagnated at a high monthly rate of 2.0%, while expectations for the coming months remain similar.

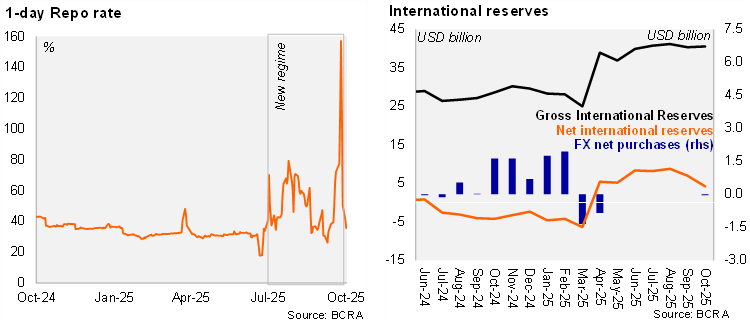

Higher interest rates have affected the credit market and increased delinquency in the banking system, especially among households. Net reserves are low (around USD 4.0 billion), so accumulating reserves is a priority, both to comply with the IMF program and to make foreign currency debt payments in 2026. We believe there are two possible strategies to achieve this goal: one is through the capital account, which involves placing debt on the international market or receiving foreign direct investment. The other is through government purchases of dollars in the official exchange market. Given the government official’s strong defense of the current exchange rate regime with floating bands, a complete overhaul of the framework seems unlikely, yet it might be slightly tweaked to allow for a higher ceiling. However, we cannot rule out a new agreement with the IMF that revises the program's targets, particularly in the monetary and exchange rate areas. In the medium term, completely lifting exchange controls remains a pending task.

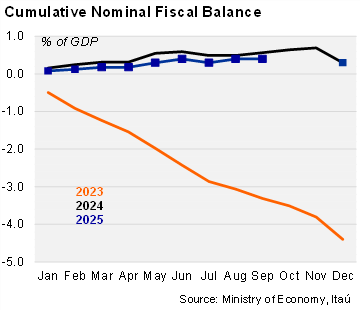

There is a separate chapter for the fiscal framework. Despite it being an election year and activity falling marginally, the government maintained the fiscal surplus by controlling spending. According to the latest published data, the cumulative primary balance reached an estimated surplus of 1.3% of GDP during the first nine months of the year, while the cumulative nominal balance reached a surplus of 0.4% of GDP. These results align with the official target of a primary fiscal surplus of 1.5% of GDP by 2025.

Our take: The government achieved far better-than-expected results with respect to polls, on the back of a period of mounting financial stress. Importantly, the government was able to maintain the crucial veto thresholds. However, achieving greater consensus is necessary to advance the economic deregulation agenda and vote on key laws, such as Bases Law II and the Budget. Therefore, the market will likely view the President's invitation to the opposition to advance a reform agenda positively.