Following its approval by the Lower House in May, the “Bases” bill was approved by the Senate on June 12 with a casting by the chair of the Upper House, Vicepresident Villarroel. While the approved text is a significantly watered down version of the original bill proposed by the government (only one third of the original bill survived), the outcome is positive for the government and its efforts to deregulate the economy, foster investment, and gradually improve fiscal accounts.

The Bases bill includes the assignment of the so-called delegated powers to the government, reorganization of the public administration, privatizations, investment policy in Argentina and labor reform, among other elements. In a separate bill, an also diluted fiscal package was approved, as changes in the income and wealth taxes were rejected. Now, both Bases and the fiscal package return to the lower chamber for a final approval, where the Lower House may incorporate the Senate’s rejected changes on income and wealth taxes. If the bills are approved without the Senate’s changes, we estimate additional tax revenues of ~0.5% of GDP, key to fiscal consolidation and the IMF targets, consistent with a primary surplus of 2.0% of GDP in 2024 (from a deficit of 2.7% in 2023).

Brief description of the main items included in the Bases bill. In terms of delegated powers, the bill declares an administrative, economic, financial and energy emergency for one year and grants Milei special powers to legislate in these areas. The reorganization of the public administration aims to provide different mechanisms to improve the efficiency of the State. Regarding investment policy in the country, the Large Investment Incentive Regime (so called RIGI) grants special benefits for investments exceeding USD 200 million and aims to provide legal certainty for large investors. The labor reform basically aims to modernize and formalize the job market.

The approval of the bill should enhance the federal government’s bargaining power in negotiations with the provinces. Following the Senate’s approval of the Bases bill, the president called for an agreement on ten key policies, the so-called Pact of May, which includes:

1. The inviolability of private property.

2. Non-negotiable fiscal balance.

3. Reduction of public spending to historically low levels.

4. Tax reform to reduce the tax burden, simplify the lives of Argentines, and promote commerce.

5. Reconsideration of federal tax sharing to permanently end the current “extortive model.”

6. A commitment from provinces to advance in the exploitation of the country’s natural resources.

7. Modern labor reform to promote formal employment.

8. Pension reform to ensure the system’s sustainability, respect for contributors, and the option for private pension subscription.

9. Structural political reform to realign the interests of representatives and the represented.

10. Opening to international trade, to transform Argentina into a global player.

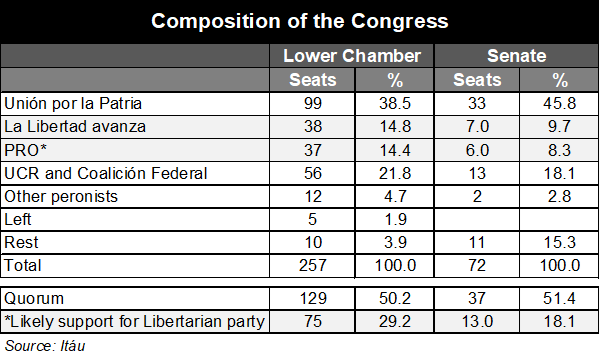

Our take: The Senate’s approval of the Bases bill and fiscal reform are positive steps for the government, as it could be a turning point for the ambitious deregulation agenda proposed by President Milei. However, despite the recent victory, the position of the government in Congress remains weak in comparison with the opposition (see table above), leading the government to enter hard negotiations to pass further laws (as the case of the Bases Law). Confidence in the administration remains elevated according to the Universidad Torcuato di Tella’s index (50% in May from 57% in December 2023), despite high inflation and falling activity, and provides the administration more bargaining power with Congress and provinces. All in all, the bill’s approval should mark a turning point in President Milei’s ambitious deregulation agenda, triggering an improvement in investment and a further improvement in our fiscal projections (primary budget surplus of 0.5% of GDP in 2024).