2026/01/05 | Andrés Pérez M. & Pedro Schneider

Following the US military operation to Venezuela and the capture of Nicolás Maduro, the regime still stands, as questions arise as to the effects these events may have on the broader region.

In our view, short-term effects on the region are likely to be negligible.

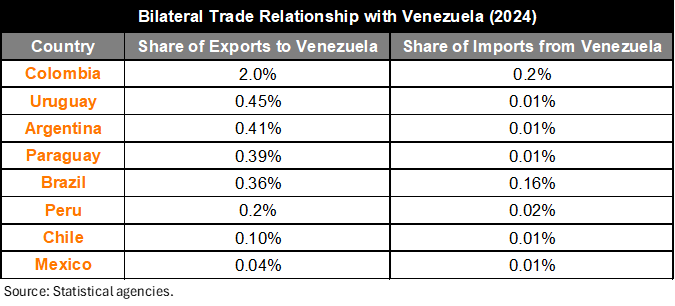

First, Venezuela’s trade and financial linkages to the rest of the region have fallen over the past decade to practically insignificant levels.

Second, as the current regime is still in place, large migration flows back to Venezuela seem unlikely. Under the current administration, US pressure may lead to the facilitation of migrant flows back to Venezuela, a positive development for the policy agendas in countries like Chile and Peru.

Third, Venezuela does not have the ability to materially increase oil output in the short term, and transitory disruptions to oil production are unlikely to persistently alter international oil price dynamics. Venezuela currently produces roughly 1 million barrels per day, about 1% of global output, well below the 3.5 million barrels produced in the late nineties. If, for some reason, production increases swiftly, we estimate that an additional million barrels per day should decrease prices by approximately 15%, hence suggesting an increase of such a magnitude could lower prices toward USD50 per barrel.

From a geopolitical standpoint, recent events are relevant on at least two angles. First, they reiterate the US’ focus on the Western Hemisphere. Second, geopolitical tensions are likely to remain high, which, put together with elevated trade and policy uncertainty, should keep risk premium high and contribute to the gradual erosion of the dollar.

Over time, a transition to a stable, legitimate democracy in Venezuela that reinstalls confidence in the institutional framework may draw significant economic upsides to the country and the region at large.