2025/10/07 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

At today's monetary policy meeting, the central bank’s Monetary Policy Committee (MPC) unanimously cut the policy rate by 50-bps to 8.25%, reducing the restrictiveness of the contractionary stance of monetary policy. The 50bps cut was above our call and consensus for a third consecutive 25-bps cut.

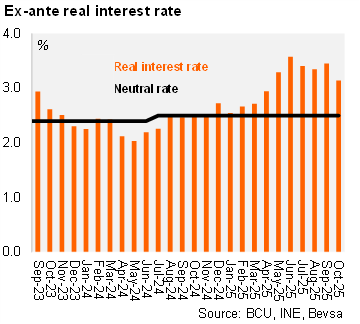

The central bank's statement emphasized that monetary policy is gaining credibility in a context of historically low inflation expectations, particularly noting the downward revision of business inflation expectations to 5.5% (from 6.0%), which entered the tolerance range for the first time. Average inflation expectations stand at 4.95%, within the tolerance range for the fifth consecutive month. Consequently, we estimate the ex-ante real policy rate at 3.14% (also including the expectations from businessmen), above the center of the BCU’s neutral real rate range estimate of 2.5%.

Furthermore, the BCU stated that the projections for economic activity within the monetary policy horizon (MPH) were slightly lowered due to the regional situation, though they remain within potential. In this context, inflation is expected to be slightly below the previous quarter's forecast, though it will converge toward the target in the MPH.

The Central Bank mentioned that lower inflation, and inflation expectations would lead to further cuts towards neutral.

Our take: The central bank seems comfortable with inflation and inflation expectations converging. At this COPOM, they highlighted the downside of businesses' inflation expectations. We expect the BCU to cut the policy rate bringing the rate down to 8% by the end of 2025. The next monetary policy meeting will be held on November 18.