2025/12/23 | Diego Ciongo & Soledad Castagna

At today's monetary policy meeting, the central bank’s Monetary Policy Committee (MPC) unanimously cut the policy rate by 50-bps to 7.50%, around neutral levels. The easing cycle has accumulated 175 bps since July. The 50bps cut was greater than our call and consensus, which anticipated a second consecutive 25-bps cut.

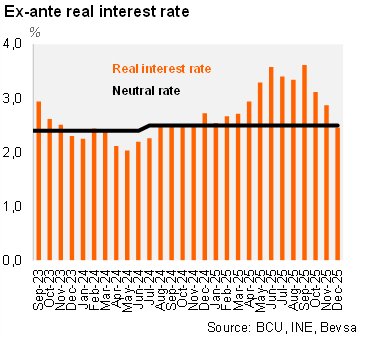

The central bank's statement reiterated that the BCU's short-term inflation projections were revised downward due to greater weakness in domestic import prices. The persistence of deviations in inflation levels from the 4.5% target represents a challenge for monetary policy. Average inflation expectations for the monetary policy horizon (24 months) stand at 4.92% (4.98% in the previous meeting), within the tolerance range for the seventh consecutive month. Consequently, we estimate the ex-ante real policy rate at 2.46%, in line with BCU’s neutral real rate estimate of 2.5%.

Furthermore, the BCU stated that economic activity performed below expectations and growth prospects for this year have been revised slightly down. For 2026 and 2027, GDP is expected to evolve around its potential growth, although now with downside risks. Moreover, the BCU mentioned that if inflation and its determinants continue to follow the expected trajectory, the interest rate path could shift towards a more expansionary phase, in line with the objective of price stability.

Finally, the BCU announced the calendar of meetings for 2026, to be held on 12 February, 21 April, 26 May, 30 June, 18 August, 6 October, 17 November and 22 December.

Our take: Our terminal rate forecast stands at 7.25%, assuming inflation expectations continue to converge toward the target. However, our projection carries downside risks, as inflation is expected to remain below the 4.5% target, at least during the first half of 2026.