2025/08/19 | Diego Ciongo & Soledad Castagna

At today's monetary policy meeting, the central bank’s Monetary Policy Committee (MPC) unanimously decided to cut the policy rate by 25- bps to 8.75%, maintaining the contractionary stance of monetary policy. The decision was in line with our call.

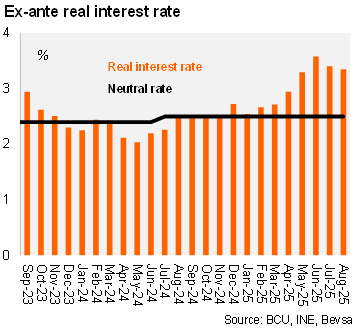

The central bank's statement highlighted that inflation expectations are at historic lows, with falling inflation expectations. The average inflation expectations stand at 5.23%, within the tolerance range for the fourth month in a row. Consequently, we estimate the ex-ante real policy rate at 3.35% (also including the expectations from businessmen), above the center of the BCU’s neutral real rate range estimate of 2.5%.

On the global front, the BCU highlighted that inflationary risks stemming from trade tensions are evident, while the international growth outlook shows a slight improvement compared to the previous COPOM.

The Central Bank mentioned that there may be room to continue reviewing the policy rate downward if inflation and inflation expectations continue to decline, particularly among businesses.

Our take: The central bank seems comfortable with inflation and inflation expectations converging, but it is particularly focused on business expectations. We expect the BCU to cut the policy rate at the next few policy meetings, bringing the rate down to 8% by the end of 2025. The next monetary policy meeting will be held on October 7.