2025/11/18 | Diego Ciongo & Soledad Castagna

At today's monetary policy meeting, the central bank’s Monetary Policy Committee (MPC) unanimously cut the policy rate by 25-bps to 8.00%, reducing the pace from the previous meeting (-50 bps). The 25bps cut was above our call , as we expected a hold, but in line with consensus.

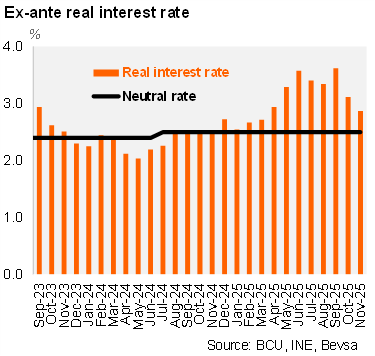

The central bank's statement reiterated that monetary policy is gaining credibility amid historically low inflation expectations. Short-term inflation projections remain stable compared to the previous Copom meeting. Average inflation expectations for the monetary policy horizon (24 months) stand at 4.98% (4.95% in the previous meeting), which is within the tolerance range for the sixth consecutive month. Consequently, we estimate the ex-ante real policy rate at 2.87%, somewhat above the BCU’s neutral real rate estimate of 2.5%.

Furthermore, the BCU stated that economic activity continues to grow close to its potential level, with an output gap close to zero. Inflation at the policy horizon is projected to fall below the target. The communiqué also mentions that the Copom will gradually transition to making further cuts towards neutral.

Our take: We were surprised by today’s decision, considering the rise in inflation expectations among analysts since the last COPOM meeting. However, the central bank seems comfortable with the evolution of inflation expectations. We expect the BCU to cut the policy rate in the next meeting by 25-bps to 7.75%. The next monetary policy meeting is scheduled for December 23.