2026/01/05 | Diego Ciongo & Soledad Castagna

Inflation fell by 0.09% MoM in December (from +0.34 a year ago and a 5-year median of -0.03%), below market expectations according to the BCU’s survey (+0.10% MoM). The main monthly impact came from housing, electricity and water which fell by 1.44% MoM (incidence of -0.19 p.p.), primarily driven by the effect of the application of the "UTE rewards" program on the electricity supply bill. On the other hand, food and non-alcoholic beverages prices fell by 0.36% MoM (incidence -0.10 p.p.) due to lower vegetable prices (-5.77% MoM), while transport prices dropped by 0.29% MoM (incidence of -0.03 p.p.) given lower flight tickets. On the other hand, restaurant prices rose by 1.15% MoM (incidence of +0.10 p.p.), while recreation prices rose by 1.08% MoM (incidence of +0.06 p.p.).

Core inflation (CPI CE VFC) (excluding fruits & vegetables and fuel prices) increased slightly by 0.04% MoM, from 0.51% MoM in December 2024. The CPI-CE VFCTA, which excludes almost 26% of the general basket (fruits and vegetables, fuels, and centrally priced or administered products) rose by 0.24% MoM, from 0.87% MoM in the same month one year ago.

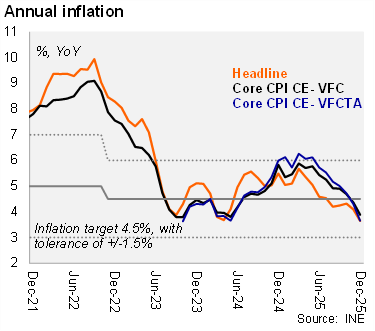

All CPI readings drifted below the Central Bank's 4.5% target, yet within the tolerance range. Headline inflation fell to 3.65% YoY in December from 4.09% in November, while the core reading decreased to 3.89% from 4.37% in the previous month. The CPI-CE VFCTA fell to 3.66% YoY, from 4.31% YoY in November.

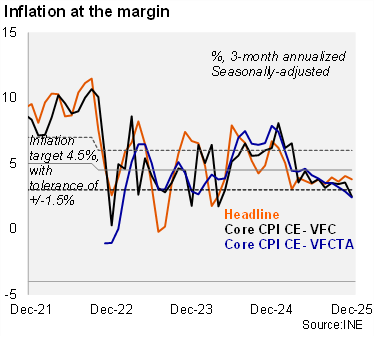

At the margin, inflation eased in December. Using our seasonally adjusted figures, the three-month annualized headline inflation fell to 3.8% in December (from 4.1% in November), while core inflation dropped to 2.5% from 3.6% before. Finally, the CPI-CE VFCTA reading fell to 2.4%, from 2.9% in the previous month.

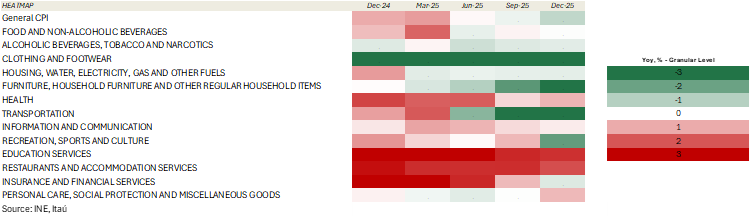

Our CPI heatmap shows that 62% of selected items are below the central bank’s target (4.5%), above the previous month (54%), and much better than December 2024 figures (15%).

Our Take: Our inflation forecast for YE26 stands at 4.5%, in line with the central bank's target. January's CPI, which includes the reversal of the temporary seasonal discount on electricity and increases in tariffs (electricity, telephone, internet, and water services), will be released on February 4.