2025/10/03 | Diego Ciongo & Soledad Castagna

Inflation rose by 0.42% MoM in September (from +0.37 a year ago and a 5-year median of +0.59%). The print was above our forecast and market expectations according to the BCU’s survey (0.25% MoM and 0.33% MoM, respectively). The main monthly impact in September came from food and non-alcoholic beverages prices, which rose by 0.63% MoM (incidence +0.16 p.p.) due to higher meat prices (2.38%) and vegetables and legumes prices (1.26% MoM). On the other hand, transport fell 0.60% MoM (incidence -0.06 p.p.) due to the decrease in the prices of Vehicles (-1.02% MoM), mainly explained by stronger UYU and lower gasoline prices.

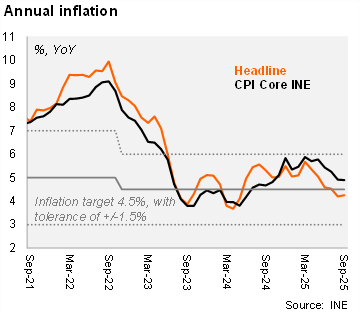

Core inflation (CPI CE VFC) (excluding fruits & vegetables and fuel prices) increased by 0.32% MoM, from 0.34% MoM in September 2024. On an annual basis, headline inflation slightly rose to 4.25% in September (from 4.20% in August), while core decreased to 4.90% from 4.92% in the previous month. Cumulative headline inflation in the year reaches 3.19%. We note that both readings remain within the Central Bank's tolerance range for its inflation target of 4.5% ± 1.5%. Moreover, headline inflation continues to be lower than BCU’s target.

The national statistics institute (INE) released for first time a new core CPI measure called CPI-CE VFCTA, which excludes almost 26% of the general basket (fruits and vegetables, fuels, and centrally priced or administered products). Thus, CPI-CE VFCTA rose 0.23% MoM and 5.0% yoy.

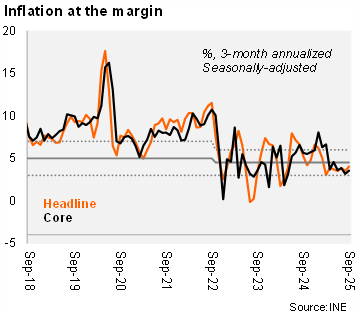

At the margin, headline and core inflation accelerated in September. Using our own seasonally adjusted figures, the three-month annualized headline inflation rose to 4.0% in September (up from 3.5% in August), while core inflation was 3.5% (up from 3.2% in the previous month).

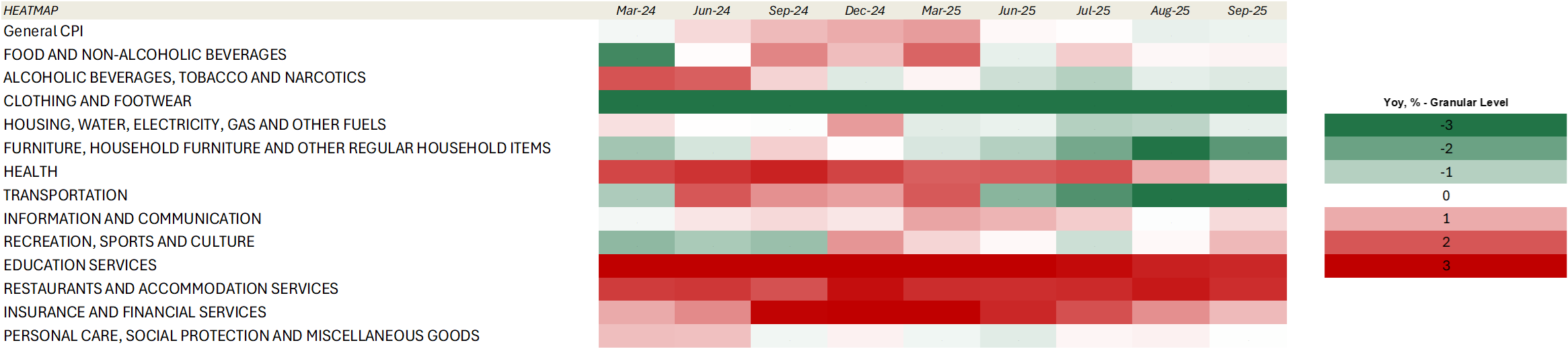

Our CPI heatmap shows that 46% of selected items are below the central bank’s target (4.5%), the same figure as the previous month (46%), but better than December 2024 figures (15%).

Our take: Our inflation forecast for YE25 stands at 3.6%. October's CPI will be released on November 5, and the next monetary policy meeting is scheduled for October 7. Given well-behaved inflation and falling inflation expectations, we anticipate that the BCU will reduce the policy rate by an additional 25 basis points to 8.50% at the next meeting.