2025/08/05 | Diego Ciongo & Soledad Castagna

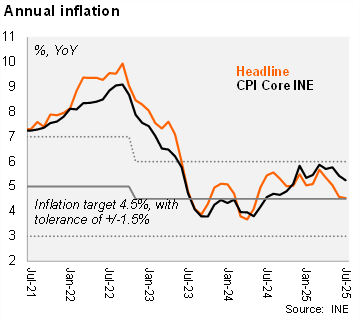

Inflation rose by 0.05% MoM in July (from +0.11 a year ago and a 5-year median of +0.32%). The print was well below our forecast and market expectations according to the BCU’s survey (0.2% MoM and 0.3% MoM, respectively). Notably, this is the fourth consecutive downside inflation surprise with respect to market consensus. The main monthly impact in July came from food and non-alcoholic beverages prices, which rose by 0.31% MoM (incidence 0.08 p.p.) due to higher vegetables and legumes prices (4.95% MoM), while personal care and social protection prices rose by 1.03% MoM (incidence of 0.045 p.p.). On the other hand, housing, water, electricity and gas prices fell by 0.56% (incidence of -0.07 p.p.), while seasonal clothing and footwear prices fell by 2.0% (incidence of 0.05 p.p.). Core inflation (excluding fruits & vegetables and fuel prices) increased by 0.03% MoM, from 0.2% MoM in July 2024. On an annual basis, headline inflation fell to 4.53% in July (from 4.59% in June), while core decreased to 5.25% from 5.43% in the previous month. We note that both readings remain within the Central Bank's tolerance range for its inflation target of 4.5% ± 1.5%. Moreover, headline inflation is now at the BCU's target.

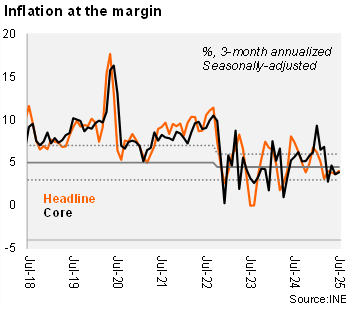

At the margin, headline and core inflation accelerated in July. Using our own seasonally adjusted figures, the three-month annualized headline inflation rose to 4.1% in July (up from 3.7% in June), while core inflation was 3.9% (up from 3.6% in the previous month).

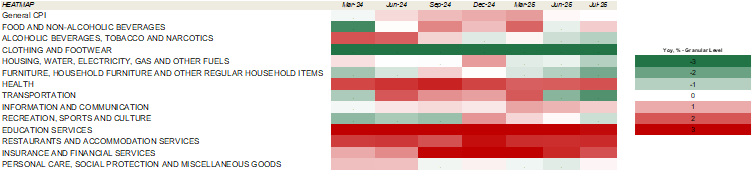

Our CPI heatmap shows that 46% of selected items are below the central bank’s target (4.5%), worse than the previous month (54%), but better than December 2024 figures (15%).

Our take: We recently revised our YE25 inflation forecast down from 4.7% to 4.5%, due to a string of lower-than-expected inflation figures and a stronger UYU. August's CPI will be released on 3 September, and the next monetary policy meeting is scheduled for 18 August. Amid well-behaved inflation and falling inflation expectations, we expect the BCU to cut the policy rate by a further 25 basis points to 8.75% at the next meeting.