2025/11/05 | Diego Ciongo & Soledad Castagna

Inflation rose by 0.40% MoM in October (from +0.33 a year ago and a 5-year median of +0.55%). The print was above our forecast and market expectations according to the BCU’s survey (0.24% MoM and 0.30% MoM, respectively). The main monthly impact in October came from food and non-alcoholic beverages prices, which rose by 0.85% MoM (incidence +0.22 p.p.) due to higher meat prices (1.12%) and fruit prices (2.68% MoM). On the other hand, clothing and footwear prices rose by 2.07% (incidence 0.05 p.p.) due to the start of the spring-summer season.

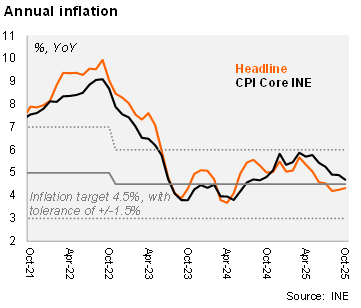

Core inflation (CPI CE VFC) (excluding fruits & vegetables and fuel prices) increased by 0.37% MoM, from 0.57% MoM in October 2024. On an annual basis, headline inflation rose to 4.32% in October (from 4.25% in September), while core decreased to 4.69% from 4.90% in the previous month. We note that both readings remain within the Central Bank's tolerance range for its inflation target of 4.5% ± 1.5%. Cumulative headline inflation in the year reaches 3.60%.

The national statistics institute (INE) also released a core CPI measure called CPI-CE VFCTA, which excludes almost 26% of the general basket (fruits and vegetables, fuels, and centrally priced or administered products). Thus, CPI-CE VFCTA rose 0.43% MoM, from 0.23% MoM in the previous month.

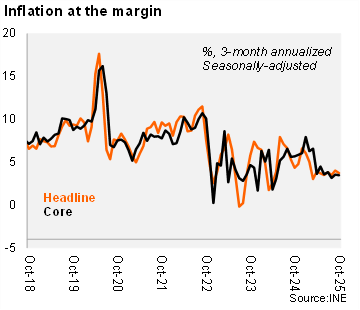

At the margin, headline and core inflation were mixed in October. Using our own seasonally adjusted figures, the three-month annualized headline inflation fell to 3.7% in October (from 4.0% in September), while core inflation remained unchanged at 3.5%.

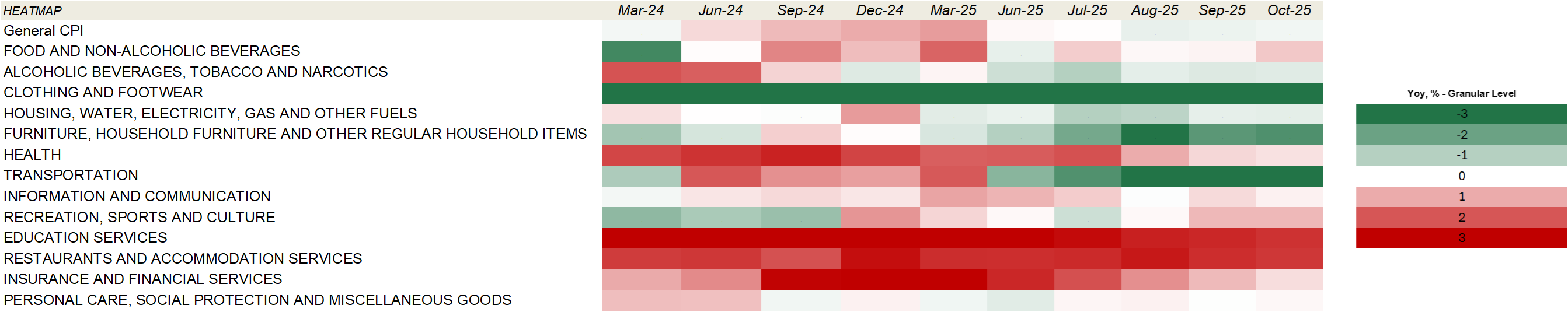

Our CPI heatmap shows that 38% of selected items are below the central bank’s target (4.5%), below the previous month (46%), but better than December 2024 figures (15%).

Our take: We see upside risks to our inflation forecast for YE25 of 3.6% given the upside October surprise. November´s CPI will be released on December 5, and the next monetary policy meeting is scheduled for November 18. Given unchanged inflation expectations among businessmen in the latest survey, coupled with the acceleration in annual inflation, we anticipate a slower pace of rate cuts than at the previous meeting (50 bps). Moreover, depending on market expectations to be published before the next meeting, we cannot rule out a pause in the cycle of monetary easing that began last July.