In today’s monetary policy meeting, the central bank’s Monetary Policy Committee (MPC) unanimously maintained the policy rate at 9.25%, pausing the tightening cycle that began in December 2024 after three consecutive 25-bps hikes. The decision was in line with the Bloomberg market median but differed from our call for a final 25-bp hike to 9.50%.

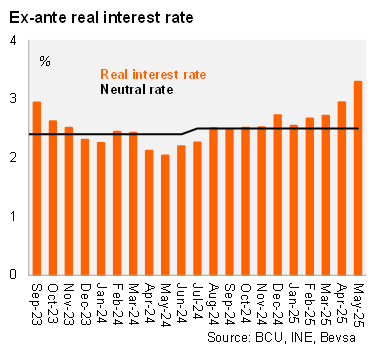

In the statement, the central bank highlighted that annual inflation has remained within the inflation target’s tolerance range (3%-6%) for almost two years. Inflation expectations for the following twenty-four months (the monetary policy horizon) fell to 5.5% in the analyst survey (down from 5.8%) and to 5.3% in the financial markets (down from 6.1%). As a result, we estimate the ex-ante real policy rate at 3.30% (also including the expectations from businessmen), above the center of the BCU’s neutral real rate range estimate of 2.5%.

Mixed signals for the final decision. The committee recognized that inflation expectations and inflation have dropped, while economic growth has lost momentum. On the other hand, core inflation remains high and persistent, and inflation expectations continue to be significantly above the target of 4.5%.

Our take: That’s all folks. While the statement does not provide clear forward guidance, we believe it is consistent with the end of the tightening cycle. We do not anticipate further changes in the policy rate for the rest of the year. The next monetary policy meeting will be held on July 8.