Headline inflation rose by 0.32% MoM in April (from 0.63% a year ago and a 5-year median figure of 0.87%). The print was below our forecast and market expectations according to the BCU’s survey (0.56% MoM and 0.48% MoM, respectively). The main monthly impact came from the food basket (0.78% MoM, incidence of 0.20 p.p.) driven by higher meat prices (2.62% MoM) and volatile vegetables and legumes (1.82% MoM). On the other hand, transport prices fell by 0.27% MoM due to lower diesel prices. Core inflation (excluding fruits & vegetables and fuel prices) increased by 0.35% MoM, from 0.52% MoM in April 2024. On an annual basis, headline inflation decelerated to 5.36% in April (from 5.67% in March), while core inflation also decelerated to 5.70% from 5.88% in the previous month. We note both readings remain within the Central Bank's inflation target of 4.5% +/- 1.5%.

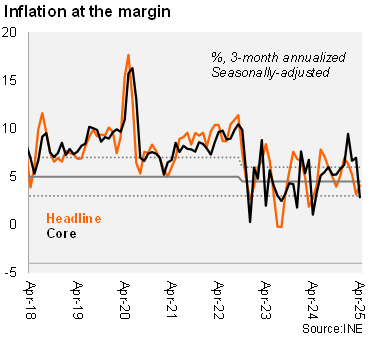

At the margin, headline inflation accelerated, while the core reading decelerated in April. Using our own seasonally adjusted figures, the three-month annualized headline inflation rose to 4.1% in April (from 3.2% in March), while core inflation was 2.9% (from 7.0% in the previous month).

Our CPI heatmap shows that 38% of selected items are below the center of the central bank’s target (4.5%), from 31% in March.

Our take: Our year-end 2025 (YE25) inflation forecast is 5.5%, but there is downside risk due to a strong UYU and lower oil prices. May's CPI will be released on June 4, while the next monetary policy meeting is on May 27. While our base scenario is a new 25-basis point hike to a terminal rate of 9.50%, we cannot rule out a pause in the cycle due to lower inflation readings and a stronger UYU.