2025/09/16 | Diego Ciongo & Soledad Castagna

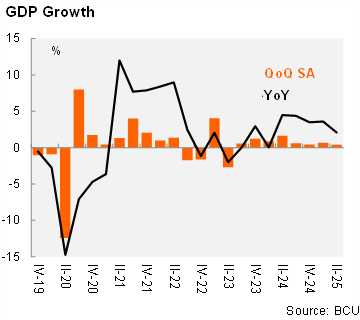

GDP rose by 2.1% yoy in 2Q25, down from 3.6% in 1Q25. At the margin, using the central bank's seasonally adjusted series, GDP grew by 0.4% qoq/sa in 2Q25, the same figures that the monthly GDP proxy IMAE anticipated. This marks the eighth consecutive quarter of sequential expansion. Furthermore, the BCU adjusted past data. In 1Q25, the GDP grew by 0.68% qoq/sa, instead of 0.5% qoq/sa published in the previous report. Thus, the statistical carryover for 2025 stands at 2.0%.

Mixed signals across the sectors. On the supply side, the annual print was mainly driven by the livestock and agriculture sector, which expanded by 10.6% YoY in 2Q25 with an incidence of 0.8 p.p, due to the higher production of summer crops, mainly soybeans and corn. This was associated with higher yields in the 2024/2025 harvest compared to the previous one. Additionally, there was an increase in cattle slaughter and milk referral to industrial plants. Furthermore, manufacturing increased by 7.6% yoy, also with an incidence of 0.8 pp, driven by higher oil refining and the production of cellulose pulp. On the other hand, the energy sector fell 7.9% yoy (incidence of -0.2 pp) due to lower hydropower generation and reduced exports, as well as increased imports compared to 2Q24. Additionally, construction decreased by 0.2%, driven by lower investment in other construction projects, which could not be offset by greater activity in building construction.

Domestic demand increased in 2Q25. Domestic demand rose by 2.2% yoy in 2Q25 (3.9% in 1Q25). This increase was led by a 1.7% YoY rise in consumption, driven by private expenditures (2.3% YoY), partially offset by lower public expenditures (-0.5% YoY). Moreover, gross capital formation rose by 4.7% yoy, due to an increased accumulation of stocks, primarily grains, resulting from a larger summer crop harvest. On the external demand, exports of goods and services rose by a mere 0.5% yoy (from 3.8% in 1Q25), due to increased sales of cellulose, soybeans, and meat, while sales of rice and electricity decreased. Notably, there was an increase in exported business services and tourism, the latter associated with a greater inflow of Argentine tourists. Imports of goods and services rose by 0.7% yoy (from 4.9% yoy in 1Q25) due to higher imports of durable goods, pharmaceuticals, apparel, and meat.

Our take: Our GDP growth forecast for 2025 stands at 2.3%. The revision of 1Q25 figures growth (seasonally adjusted) to the upside reduces the downside risks for our call given a higher statistical carryover.