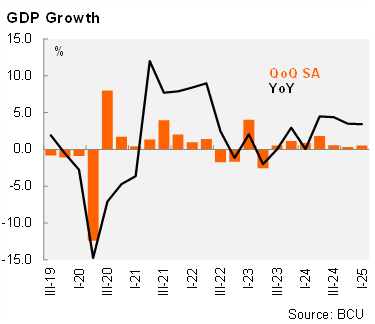

GDP rose by 3.4% yoy in 1Q25, down slightly from 3.5% in 4Q24. At the margin, using the central bank's seasonally adjusted series, GDP grew by 0.5% qoq/sa in 1Q25, while the monthly GDP proxy IMAE pointed to growth of 0.3% qoq/sa, expanding sequentially for the seventh consecutive quarter. Thus, the statistical carryover for 2025 stands at 1.5%.

mainly driven by manufacturing (17.6% yoy, incidence of 1.6 pp) driven by higher oil refinery and the production of dairy, milling, and meat products. Financial services grew by 5.0% yoy (incidence of 0.3 p.p). Moreover, the livestock and agriculture sector expanded by 4.0% in 1Q25 with an incidence of 0.2 p.p, due to increased rice production resulting from a larger planted area and higher yields in the 2024/2025 harvest. At the same time, livestock activity increased due to greater cattle extraction for live exports and slaughter, as well as greater milk delivery to processing plants. The trade sector expanded by 2.3% yoy (with a contribution of 0.3 p.p) favored by the positive performance of accommodation services and food and beverage services, to the boost in both external and domestic demand. On the other hand, the energy sector fell 7.2% yoy (incidence of -0.2 pp) due to lower energy generation and a change in the mode of generation, given that thermal energy increased and hydraulic energy decreased. Additionally, construction fell 1.5% (incidence -0.1 p.p), driven by lower investment in energy and roads constructions. Finally, the communication and transportation sector fell 1.0% yoy in 1Q25 (incidence -0.1 p.p) due to a decline in auxiliary transport services that could not be compensated for by higher passenger transport.

Domestic demand expanded in 1Q25. Domestic demand rose by 3.8% yoy in 1Q25 (3.3% in 4Q24), led by gross capital formation which rose by 4.2% yoy. Private consumption expanded by 2.1% yoy, due to higher spending on imported consumer goods such as clothing and other durable goods. Moreover, public consumption rose by 4.3% yoy. Finally, exports of goods and services rose by 4.2% yoy (from 4.4% in 4Q24), due to the increase in inbound tourism amid spillovers from Argentina. Imports of goods and services rose by 5.6% yoy (from 3.8% yoy in 4Q24) due to higher imports of durable goods, motor vehicles, and clothing. On the other hand, due to the refinery reopening, there was a decrease in imports of fuels and gasoline and a smaller increase in oil purchases.

Our take: Our GDP growth forecast for 2025 stands at 2.3%, but now with downside risks amid somewhat lower than expected growth in 1Q25.