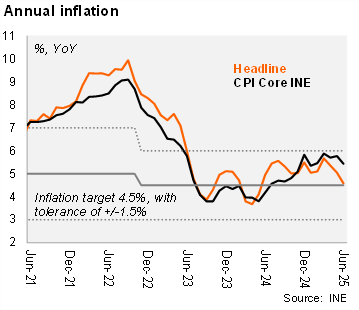

Inflation fell by 0.09% MoM in June (from +0.36 a year ago and a 5-year median of +0.23%). The print was well below our forecast and market expectations according to the BCU’s survey (0.19% MoM and 0.21% MoM, respectively). Notably, this is the third consecutive downside inflation surprise with respect to market consensus. The main monthly impact in June came from transport prices which decreased by 0.97% MoM (incidence of -0.11.p.p) due to lower cars and truck prices (-1.80% MoM), diesel prices (-4.84% MoM), passenger transportation with driver (-2.64% MoM) and lower airline tickets (-5.80% MoM). Moreover, food and non-alcoholic beverages prices fell 0.25% MoM (incidence -0.07 p.p.) due to lower vegetables and legumes (-4.20% MoM). Core inflation (excluding fruits & vegetables and fuel prices) increased by 0.09% MoM, from 0.41% MoM in June 2024. On an annual basis, headline inflation fell to 4.59% in June (from 5.05% in May), while core inflation decreased to 5.43% from 5.77% in the previous month. We note both readings remain within the tolerance range of the Central Bank's inflation target of 4.5% +/- 1.5%.

At the margin, headline and core inflation decelerated in June. Using our own seasonally adjusted figures, the three-month annualized headline inflation fell to 3.6% in June (down from 3.8% in May), while core inflation was 3.6% (down from 4.6% in the previous month).

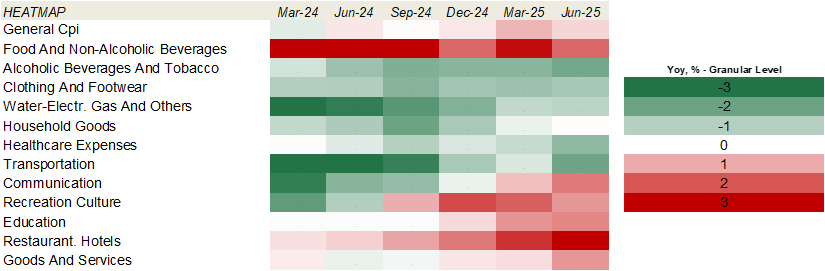

Our CPI heatmap shows that 54% of selected items are below the center of the central bank’s target (4.5%), better than the previous month (38%) and the December 2024 figures (15%).

Our take: We recently revised our YE25 inflation forecast down to 4.7% (from 5.1%), due to stronger UYU. July's CPI will be released on August 5, and the next monetary policy meeting is scheduled for July 8. We expect the BCU to keep the policy rate at 9.25% in the coming meeting. However, the string of downside inflation surprises, amid falling inflation expectations may pave the way for a rate cut earlier than we anticipated (currently penciled in for 1Q26).