2025/09/02 | Diego Ciongo & Soledad Castagna

In line with Uruguay's institutional framework, the government presented the budget bill for the 2025-2029 period to Congress, outlining three major priorities: 1) higher growth to foster better jobs, 2) strengthening social protection, and 3) improving security.

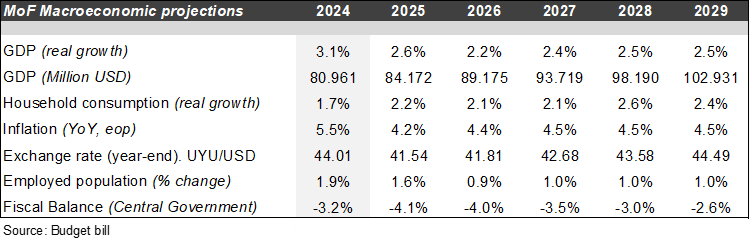

The document is crucial as it outlines the government's fiscal five-year roadmap, based on certain macroeconomic assumptions (see table below).

New taxes and more efficient collection

The budget bill includes increased tax collection through greater efficiency of the general tax authority (DGI) and tax adjustments in two main areas: 1) measures to relocate taxes currently paid abroad to Uruguay, and 2) improving horizontal equity by taxing foreign income and capital gains, incorporating an anti-abuse rule, deductions for adoption, and adjustments to express shipments. The bill does not include estimates of the expected additional revenues related to the new taxes.

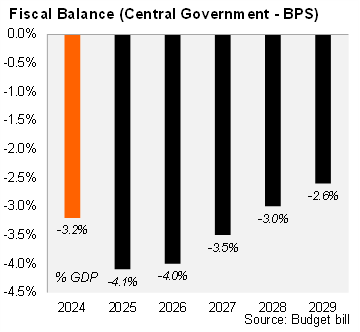

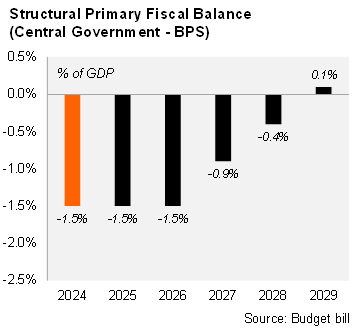

Fiscal forecasts. The overall fiscal balance of the Central Government-Social Security Bank (GC-BPS) is expected to gradually improve from -4.1% of GDP in 2025 to -2.6% of GDP in 2029, consistent with achieving a balanced primary result by the end of the forecast horizon. GC-BPS revenues are expected to rise to 28.9% of GDP in 2029, representing an increase of 1.6 percentage points compared to the 2024 forecast. Primary expenditures of the Central Government-BPS are also expected to increase to 28.9% of GDP in 2029, implying an increase of 0.9 percentage points compared to 2024.

Changes in the fiscal rule

The bill introduces changes to Uruguay's fiscal rule. The current rule has three quantitative targets: i) a goal for the structural fiscal balance; ii) a cap on the real growth of public expenditure linked to the estimated potential growth of the economy; and iii) a cap on annual net indebtedness. The new rule includes a reformulation of the fiscal framework based on two fundamental pillars: a dual rule and the strengthening of external technical councils. The dual rule aims to establish a medium-term anchor based on net debt, complemented by short-term operational targets.

Fiscal policy will be managed considering net debt of 65% of GDP as a medium-term anchor, consistent with the sustainability of the fiscal accounts. Net debt reached 59.5% of GDP in 2Q25.

Short-term operational goals. The bill proposes two operational goals: the structural fiscal balance and the indebtedness ceiling, both of which were included in the previous rule. A significant change is the elimination of the target for a cap on real growth in spending. Based on the figures included in the budget, we estimate a real expenditure growth rate of approximately 6.7% year-over-year in 2025, which includes expenditures that were postponed in 2024, as clarified in the bill.

Strengthening of external councils. The proposal includes the formation of an Autonomous Fiscal Council (CFA) with a higher degree of independence than the Advisory Fiscal Council has had until now. Under the new scheme, it is deemed necessary to initiate a process of increased resource allocation, including allowances and other financial support mechanisms, to ensure the proper functioning of the council.

The budget also includes a rule for investment in infrastructure. The draft budget proposes an annual global ceiling equivalent to 0.7% of the GDP from the immediately preceding year for future payment commitments assumed by the central government. These commitments are associated with infrastructure investment projects and their maintenance, with repayments that create obligations extending beyond the current government administration.

The fiscal targets set for the period imply a gradual reduction in the deficit, reflecting a convergence towards levels more consistent with debt sustainability. In this context, the structural primary balance shows a significant reduction, mainly from 2027 onward, reaching a slight fiscal surplus in 2029, as structural revenues exceed structural primary expenditures (before interest payments).

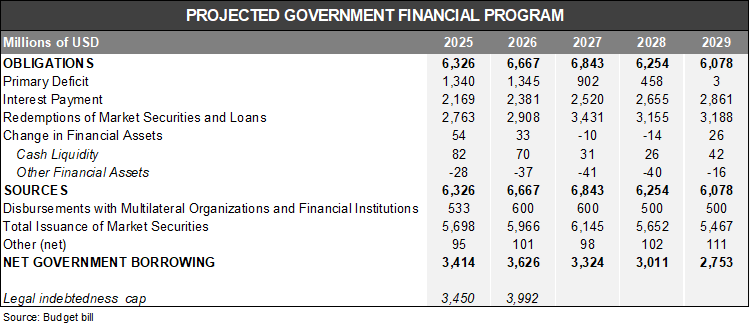

Net Indebtedness annual ceiling. Concerning the operational goal for the net indebtedness of the Central Government, the budget includes an article that sets its value at 25,115 million Indexed Units for the year 2026 (approximately USD 4.0 billion). See the table below.

The legal path to approve the budget 2026-2030

The Executive Branch sent the draft National Budget to Congress on August 31 for the period 2026-2030. The House of Representatives then has 45 calendar days to approve or reject it and pass it to the Senate. If no decision is made within that period, it is considered tacitly approved and goes to the Senate. The Senate then has 30 calendar days to consider and return it to the House of Representatives. In the second round in the Chamber of Deputies, the House of Representatives has 15 days to rule on the Senate’s modifications. In summary, Congress has a maximum of 90 days from the date of presentation to discuss and approve the Budget. If it is not voted on within that period, the Executive Branch's project is automatically approved, with the modifications accepted in due time and form.

Our take: The macroeconomic scenario included in the Budget bill appears ambitious but feasible, considering the lower expected growth for the main trading partners and the growth observed over the last decade, which averaged 1.2% per year. Market expectations, according to the central bank survey, foresee median GDP growth of 2.5% for 2025 and 2.0% for both 2026 and 2027, compared to the Budget bill's projections of 2.6%, 2.2%, and 2.4%, respectively. Regarding inflation, the budget estimates it to be anchored to the central bank's target of 4.5% or even below in the initial years. In contrast, the central bank survey indicates inflation rates of 4.5% for 2025, 4.8% for 2026, and 5.0% for 2027. Finally, the fiscal balance in the bill assumes fiscal consolidation starting only in 2027, based on higher tax collection through increased efficiency of the general tax authority and new taxes.