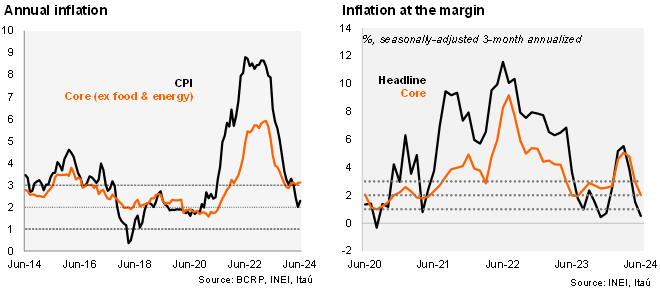

CPI increased 0.12% MoM in June (from -0.15% a year ago), above our forecast of 0.02% and broadly in line with market expectations of 0.10% (as per Bloomberg). Restaurants & Hotels, Food and Transport were the CPI groups that exerted the most upward pressure to the headline figure (together adding to a low contribution of 8-bp). Core inflation (excluding energy and food items) stood at 0.16% MoM (from 0.14% a year ago). On an annual basis, headline inflation stood at 2.29% YoY in June (from 2.00% in May), still inside the central bank's target range (2+/-1%), while core inflation stood practically unchanged at 3.12%. At the margin, the seasonally adjusted three-month annualized CPI came in at 0.52% in June (from 1.52% in May), while core inflation stood at 2.01% (from 2.97%).

Our take: Well-behaved inflation amid below trend activity supports the central bank to continue its easing cycle during the rest of the year, considering the real ex-ante rate is at 3.19% above the neutral real rate of 2.00%. We expect the central bank to cut its policy rate by 25-bp three more time during the rest of the year, reaching an end of year level of 5.00%.