2025/09/15 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

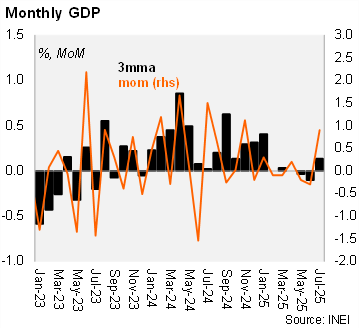

Peru’s monthly GDP proxy expanded by 3.4% year-over-year (YoY) in July, exceeding both the Bloomberg market consensus and our call of 2.5% YoY. On a seasonally adjusted basis, activity rose by an upnbeat 0.9% month-over-month (MoM), offsetting the 0.2% decline in June. Since December 2024, monthly growth has averaged just 0.1%. If activity remains at July levels through year-end, annual GDP growth would reach approximately 2%.

Primary sectors were key pulls in July. Mining expanded by 2.5% MoM (seasonally adjusted), despite disruptions caused by informal miners blocking major copper transport routes, and Fishing increased by 5% MoM. Meanwhile, Agriculture rose by 0.1% MoM.

Secondary sectors posted a mixed performance. Manufacturing rebounded by 2.7% MoM, recovering from a 2.7% MoM decline in June. Electricity generation grew by 1%. In contrast, construction contracted by 0.6% MoM.

Tertiary sectors also contributed positively. Restaurants and hotels rose by 6% MoM, boosted by national holidays. Commerce grew by 0.4% MoM, and transport increased by 0.6% MoM.

Our take: We expect real GDP to grow by 2.9% YoY in 2025, mainly driven by a rebound in mining-related investment. We estimate the output gap to be broadly closed. For 2026, we forecast GDP growth of 2.7%, slightly below the estimated potential growth rate of 3%.