2025/09/26 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

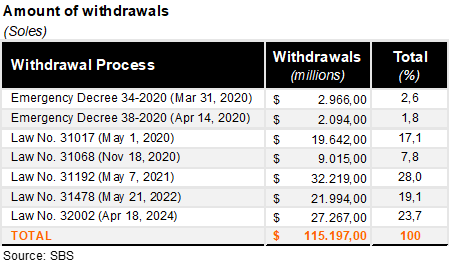

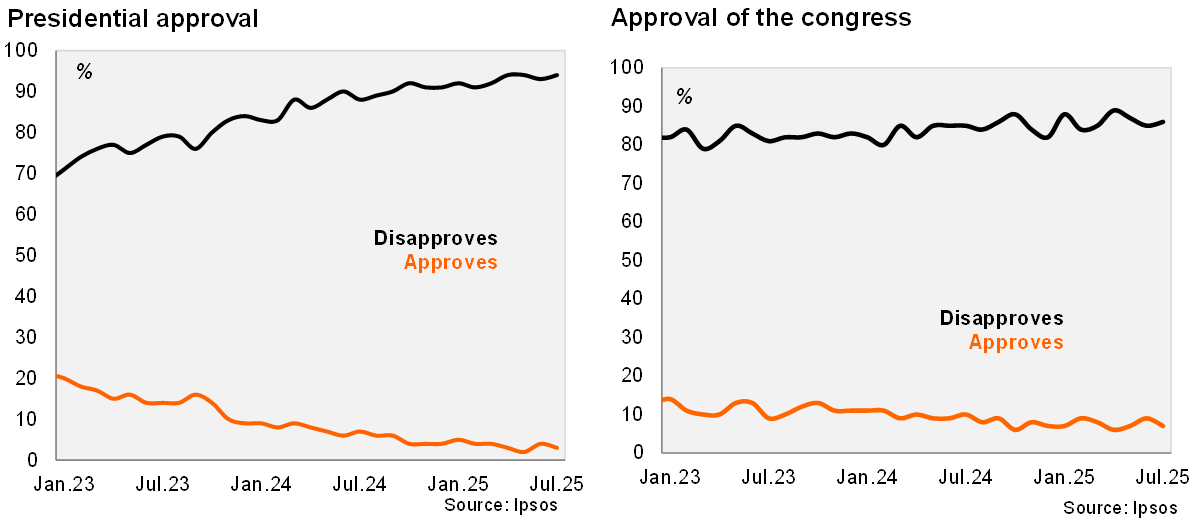

Déja vu… With general elections scheduled for April 2026 and exceptionally low approval rates for the Executive and Legislative branch, Peru’s Congress overwhelmingly and swiftly approved an eighth pension fund withdrawal estimated to reach roughly USD7.5 billion (~2.5% of GDP). The recently approved measure comes on the back of 11.5% of GDP in withdrawals to date since 2020.

In this round, savers may withdraw up to PEN 21,400 (USD 6,150) from their mandatory individual savings accounts.

In parallel, the reform reverses certain measures that were implemented last year:

• now allowing savers under 40 years of age to withdraw up to 95.5% of their savings at the time of retirement;

• the requirement for self-employed workers to contribute up to 5% of their wage to individual savings accounts starting in 2028 was eliminated;

• savers that withdrew from their accounts and had hence been denied their right to a publicly financed minimum pension, now regained their right.

Next steps. The Superintendence of Banking, Insurance, and Pension Fund Administrator must publish regulatory documentation with the withdrawal calendar by October 20. Savers will have 90 days from the publication of the regulations to submit withdrawal requests. Withdrawals should begin to be transferred to savers by the end of November.

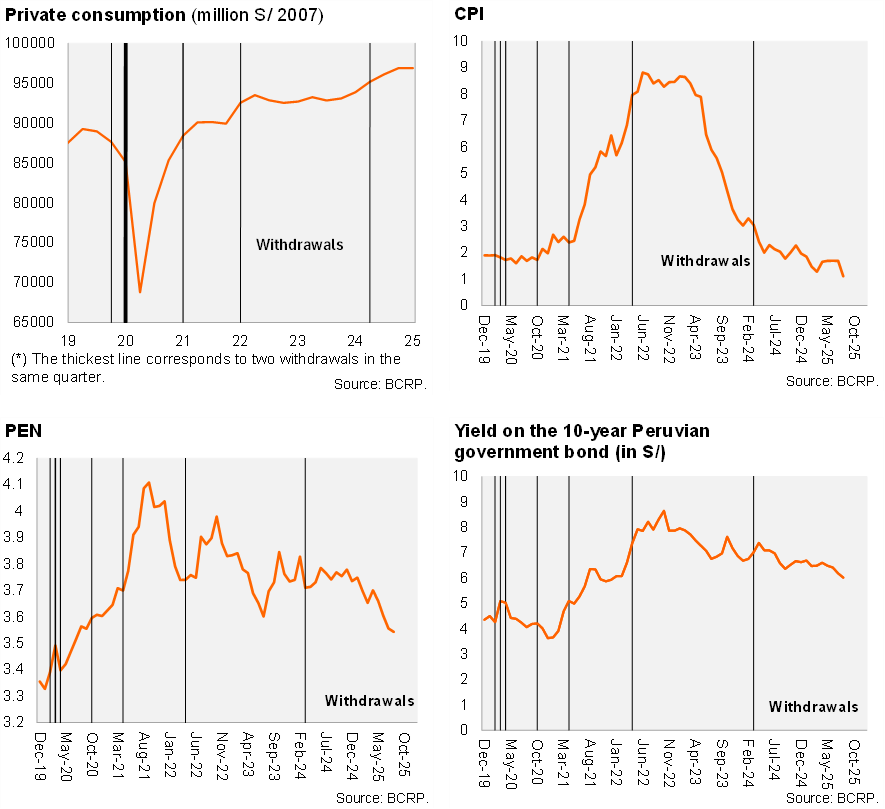

Short-term marginal support to activity, long-term financial costs

The eighth withdrawal may marginally support private consumption, as we expect mostly households with low marginal propensity to consume to still have savings. A sizable share of savers (23% of the total, 2.3 million) already wiped out their savings in their individual savings accounts. The BCRP forecasts real private consumption growth at 3.5% in 2025 and explicitly does not consider the recently approved withdrawal in its forecast. Households may also pay down debt (Consumer NPLs are at roughly 3.2% as of July 2025).

We expect inflation to remain subdued in the near term. If private consumption does indeed jump, its effects on inflation may be at least partially countered by the PEN appreciation (6.6% year-to-date).

To finance the payouts, the AFPs may need to liquidate holding of foreign assets increasing the supply of USD and supporting the PEN in the short-term.

Lower pension savings raises medium-term pressure on the fiscal accounts. The reform that created the Peruvian Comprehensive Pension System (SIPP) guarantees a minimum pension for retirees without sufficient funds in their individual accounts. The Fiscal Council has warned that changes to the pension system could lead to an increased annual fiscal cost of around 0.2% of GDP, with risks of up to 1% in the long term. The minimum pension of S/600 for those who have withdrawn their funds is the main cause of the increase in public spending. The eighth withdrawal only exacerbates the pension shortfall and fiscal coverage ahead.

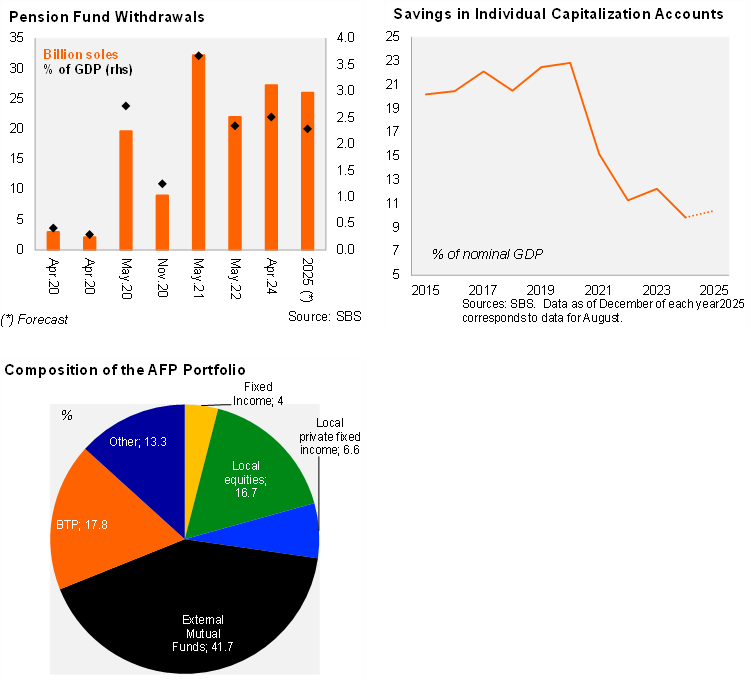

Long-term pain. Repeated pension withdrawals reduce investor confidence, lower depth and liquidity of the domestic capital market, and pose long-term risks to the sustainability of the pension system. A shift towards holding more liquid and short-term instruments to meet redemption needs may reduce long-term investment capacity and inhibit capital market development.

Withdrawal addiction

Since March 2020, seven extraordinary withdrawals from individual capitalization accounts have been approved, totaling roughly 11.5% of GDP (S/ 115 billion). As of August 2025, the pension fund’s assets under management amount to S/ 118.5 billion, which is 32% below the end of 2019 (S/ 174.8 billion). Preliminary estimates suggest that this eighth round could lead to early redemptions of approximately PEN 26.3 billion (USD 7.5 billion, 2.5% of GDP), equivalent to 23% of the total assets under management in the private pension system.

An election sweetener

The withdrawal approval takes place in the context of critically low presidential and congressional approval, as reflected by polls, with general elections scheduled for April 2026. The almost unanimous approval of the withdrawal in the plenary of Congress demonstrates the political will to approve measures that may be politically beneficial in the short term, even though long-term costs are significant.

Our take: The Peruvian economy has remained resilient amid global trade tensions and financial volatility. High commodity prices, a diversified export basket, and solid macro fundamentals (low inflation, near-potential growth) supported stability. We expect GDP to grow by 2.9% this year, around its potential, benefiting from a recovery in investment and the labor market, while inflation pressures remain well-contained. The growing fiscal burden of continued pension fund withdrawals may lead to the need for higher neutral interest rates, while the shallow capital market may weaken credit growth, investment and growth potential. Since December 2019, national savings have fallen by 11.7% of GDP. The sustained deterioration of the pension system, and the subsequent fiscal and medium-term growth implications may result in higher long-term interest rates and lower credit rating. Peru’s gross public debt of GDP sits at a low 33% of GDP, while the re-introduction of a bicameral congressional system at the upcoming election in April 2026 may reduce the persistent tension between the Executive and Legislative branch, and lower the likelihood of additional pension fund withdrawals.