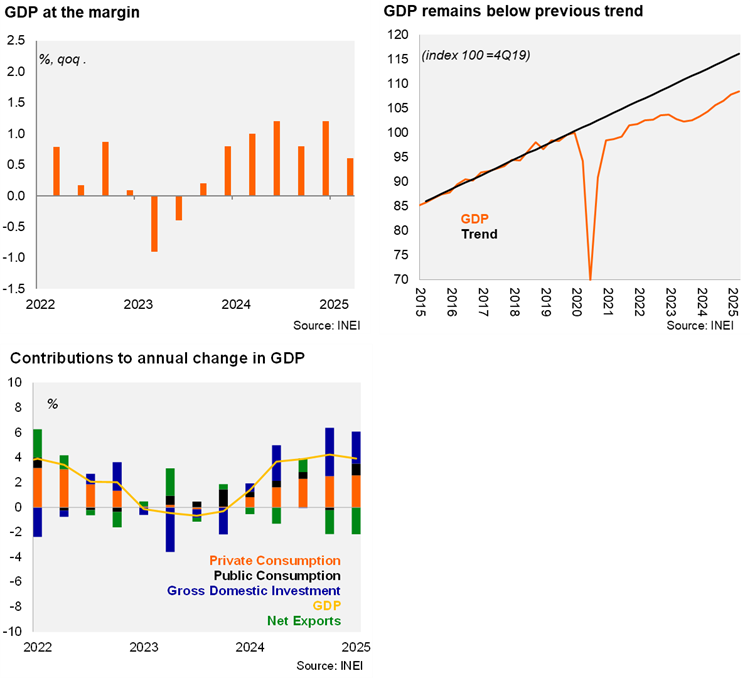

The economy grew 3.9% YoY in 1Q25, in line with the monthly GDP proxy and the Bloomberg market consensus. Private consumption (+2.6pp) and gross fixed investment (+2.1pp) were the key contributors to the annual rise. Exports posted a 9.6% YoY increase (5.2% in 4Q24), while imports rose 17% (12.3% in 4Q24), reflecting the recovery of mining investment.

Activity momentum remains positive but is decelerating. At the margin, the economy increased by 0.6% QoQ/SA in 1Q25, building on a 1.2% increase during 4Q24 and marking the seven consecutive sequential gain. Sequentially, private consumption rose by 0.7% QoQ/SA, its sixth consecutive increase, supported by a resilient labor market and the recovery of real incomes. Gross fixed investment picked up by 4.2% QoQ/SA. Exports grew by 9.5% QoQ/SA due to frontloading, while imports rose by 2.1% QoQ/SA.

Our take: The dynamics of leading indicators suggest that activity should continue to grow at a healthy pace in the near term. We still expect GDP to grow by 2.8% in 2025, supported by an investment recovery, a resilient labor market, and lower rates. However, the risk of increased domestic policy uncertainty as the presidential and legislative elections approach in April 2026, along with elevated uncertainty related to global trade may dampen private sentiment and slow the pace of activity recovery.