2025/08/01 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

Consumer prices rose by 0.23% from June to July, in line with our forecast and the Bloomberg consensus. The increase was primarily driven by higher food prices (+0.53% m/m; contribution: 0.13 pp), led by rising fish prices amid supply constraints. Transportation was another key driver (+0.5% m/m; contribution: 0.06 pp). Restaurants and Hotels rose 0.15% m/m (contribution: 0.03 pp), pressured by seasonal demand during national holidays. In contrast, the category of housing, water, electricity, gas, and other fuels declined (-0.2% m/m). Excluding volatile food and energy items, core inflation also increased by 0.2% m/m.

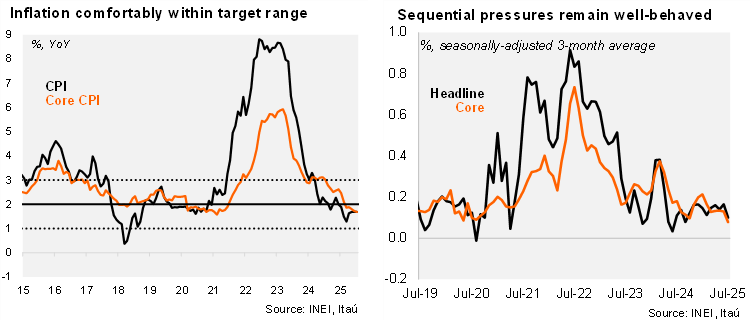

Sequential price dynamics are consistent with annual inflation near or below the 2% target. The annualized headline inflation accumulated over the last quarter reached 1.6% (SA), while core prices came in at 1.4%. On an annual basis, inflation was stable at 1.69% in July, comfortably within the ±1% tolerance range of the BCRP’s 2% inflation target. Headline inflation has been in the lower half of the Central Bank’s target range for eight consecutive months. Core inflation—excluding food and energy—rose by 1.68% y/y (in line with June), near the four-year low of 1.6%. Importantly, survey-based one-year inflation expectations have remained anchored within the target range since December 2023, holding steady at 2.3% in June.

Our take: We expect headline inflation to rise moderately in the coming months, in part due to base effects, and reach 2.2% by year-end. The balance of risks going forward is tilted to the downside, particularly if favorable exchange rate dynamics persist. The benign inflation outlook, alongside near potential economic growth supports our view that the Central Bank will continue its path toward a neutral policy rate of 4%. We forecast one additional 25 basis point rate cut this year, bringing the rate to 4.25%. The timing of the cut will likely depend on external conditions. The August inflation print is scheduled for release on September 1. We preliminarily forecast a 0.2% monthly increase.