2025/09/01 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

Consumer prices declined by 0.3% month-on-month in August, significantly below both our forecast (+0.2% m/m) and the Bloomberg consensus (+0.3% m/m). The decline was mainly driven by a sharp drop in food prices (-1.05% m/m; contribution: -0.25 pp), particularly in fish and seafood, reflecting increased supply. The Housing, Water, Electricity, Gas and Other Fuels category also contributed to the decline (-0.94% m/m; contribution: -0.09 pp), due to a 3.5% reduction in residential electricity tariffs and updated generation, transmission, and distribution costs. Transportation fell by 0.15% m/m, influenced by normalized demand for travel post-holidays and by a more favorable exchange rate. The remaining categories contributed a net 0.07 pp to monthly inflation. Core inflation, which excludes volatile food and energy items, rose by 0.08% m/m.

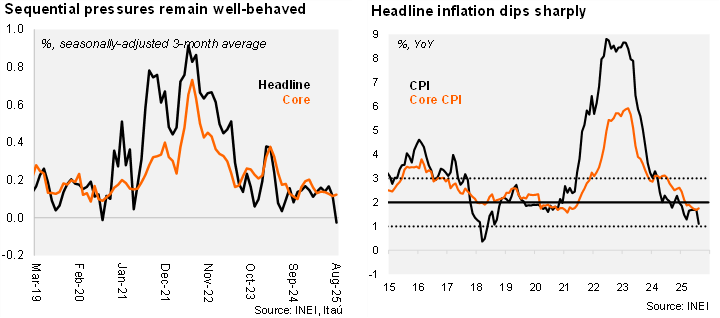

Sequential price dynamics are consistent with annual inflation hovering near the lower bound of the Central Bank’s 2% target range. Annualized headline inflation over the past quarter reached 1% (seasonally adjusted), while core inflation stood at 1.5%. On a year-over-year basis, headline inflation declined from 1.69% in July to 1.1% in August. This marks the ninth consecutive month with inflation in the lower half of the target range. Core inflation rose slightly to 1.75% y/y (from 1.7% y/y in July), remaining close to the four-year low of 1.6%. Importantly, survey-based one-year inflation expectations have remained anchored within the target range since December 2023, reaching 2.2% in July.

Our take: We expect headline inflation to increase moderately in the coming months, partly due to base effects, and to reach 2.2% by year-end. The balance of risks remains tilted to the downside. The benign inflation outlook, coupled with growth near potential, supports our expectation that the Central Bank will continue its path toward a neutral policy rate of 4%. We anticipate one additional 25 bp rate cut this year, bringing the policy rate to 4.25%. While the August inflation print was driven down by volatiles, the low figure may provide a window of opportunity for the Central Bank to respond in the near-term. The September inflation print will be released on October 1, and we preliminarily forecast a 0.2% m/m increase.