Consumer prices fell by 0.06% from April to May, following two upside surprises, printing below our 0.2% forecast (Bloomberg market consensus: 0.1%). The Food and Alcoholic Beverage category decreased by 0.5%, contributing -11 bps to headline inflation, after being the main price driver in April and March as heat affected production. Transportation fell by 0.26%, contributing -3 bps to headline inflation, while Water, Electricity, Gas, and Other Fuels fell by 0.21%. Conversely, Restaurants & Hotels increased by 0.34%, contributing +6 bps to inflation for the month. Excluding volatile food and energy items, inflation was a milder 0.05% MoM.

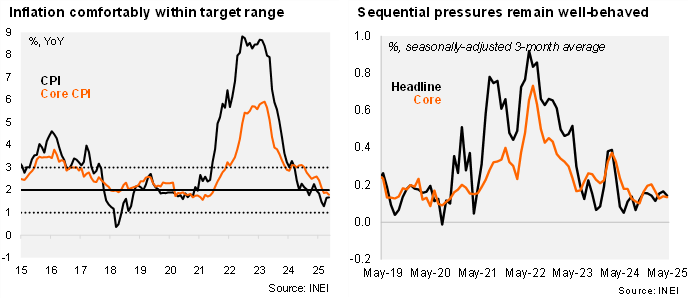

On an annual basis, inflation rose to 1.68%, from the 1.65% in April. Overall, inflation remains comfortably within the BCRP’s target range of 2% (+/- 1%). Headline inflation has stayed within the target range for fourteen consecutive months. Core inflation (excluding food and energy) rose by 1.8% YoY, nearing a three-year low. Inflationary pressures at the margin are close to the center of the target range.

Our take: We expect inflation to remain within the BCRP’s inflation target range through 2025 (2.3% by year-end). We believe the BCRP is likely to pause in the near term and eventually, and cautiously, cut rates towards 4%. The next inflation print is due July 1.