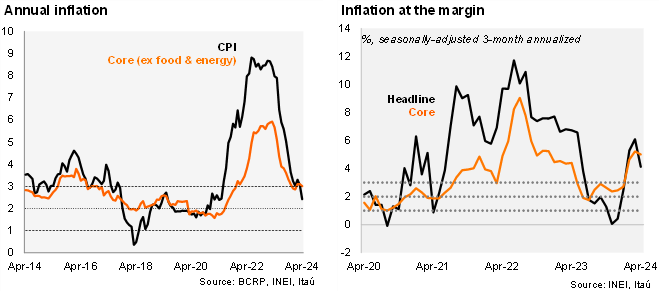

CPI fell by 0.05% MoM in April (from 0.56% a year ago), below our forecast of +0.06% and market expectations of +0.25% (as per Bloomberg). The main downside pressure to the headline inflation figure came from food prices (a negative contribution of 21 bp) which was mitigated by the other subindexes. Core inflation (excluding energy and food items) stood at 0.11% MoM (from 0.20% a year ago). On an annual basis, headline inflation fell to 2.42% YoY in April (from 3.05% in March), while core inflation stood at 3.01% (from 3.10%). At the margin, the seasonally adjusted three-month annualized CPI came in at 4.12% in April (from 6.09% in March), while core inflation stood at 5.00% (from 5.22%).

Our take: Increasing uncertainty surrounding the start of Fed’s easing cycle poses challenges for EM easing cycles, especially the BCRP due to the low interest rate differentials, scheduled to meet again on May 9. However, April’s benign inflation figure in the context of a weak recovery in economic activity increases the odds for another policy rate cut or another reserve requirement adjustment. All in all, we think the balance is now slightly biased for another rate cut of 25-bp in May (reaching a level of 5.75%). Twelve-month inflation expectations and global financial conditions for the month of April will be important determinants for the next monetary policy decision.