The monthly real GDP proxy rose by 2.7% YoY in February, well below consensus (3.4% YoY). The market was broadly divided with forecasts ranging from 2.5% YoY and 4.9% YoY.

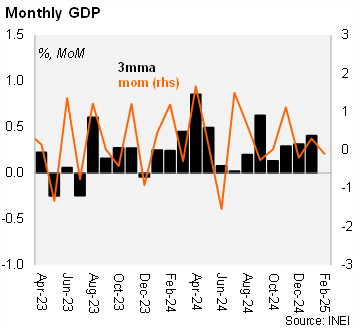

Sequentially, activity fell by 0.1% MoM/SA in February, down from +0.3% MoM/SA in January. Agriculture rose by 1.97% MoM/SA (12 bp contribution) and mining increased by 1.3% MoM/SA (19 bp contribution), while fishing fell by 5.3% MoM/SA (-4 bp contribution). Manufacturing fell 1.1% MoM/SA in February (-19 bp contribution).

Services were mixed. Restaurants & hotels fell 2% MoM/SA, extending the January decline (-0.4%). Financial & insurance services dropped by 0.72% MoM/SA. Otherwise, transport and commerce rose by 0.8% MoM/SA and 0.6% MoM/SA, respectively. Telecommunications and financial services ticked up by 0.7% MoM/SA and 0.51% MoM/SA. Following February's monthly GDP data, the carryover for 2025 stands at 1.8%.

Our take: Despite the weaker-than-expected print in February, we expect GDP to grow 2.8% this year. Certainly, heightened global policy uncertainty poses downside risks to Peru’s growth outlook. However, Congress is discussing an eighth pension fund withdrawal, which could total between 2-3% of GDP, that could provide an additional transitory boost to private consumption. For 2026, we anticipate GDP growth of 2.7%.