2025/08/22 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

According to the Central Bank, Peru's economy grew by 2.8% year-over-year (YoY) in the second quarter of 2025, consistent with the monthly activity proxy (Imacec). Private consumption increased by 2.9% YoY, supported by the recovery in the real wage bill and formal job creation. Government consumption rose by 3.7% YoY. Gross Fixed Capital Formation expanded by 7.8% YoY, driven by a 9.8% YoY increase in private investment, while public investment grew by 3.2% YoY. The rise in GFCF reflects stronger investment in machinery and equipment (13.1% YoY) and a 4% YoY increase in construction activity. On the external sector, exports grew by 2.7% YoY, while imports surged to 14% YoY, reflecting a recovery in domestic demand. This led to a negative contribution from net exports.

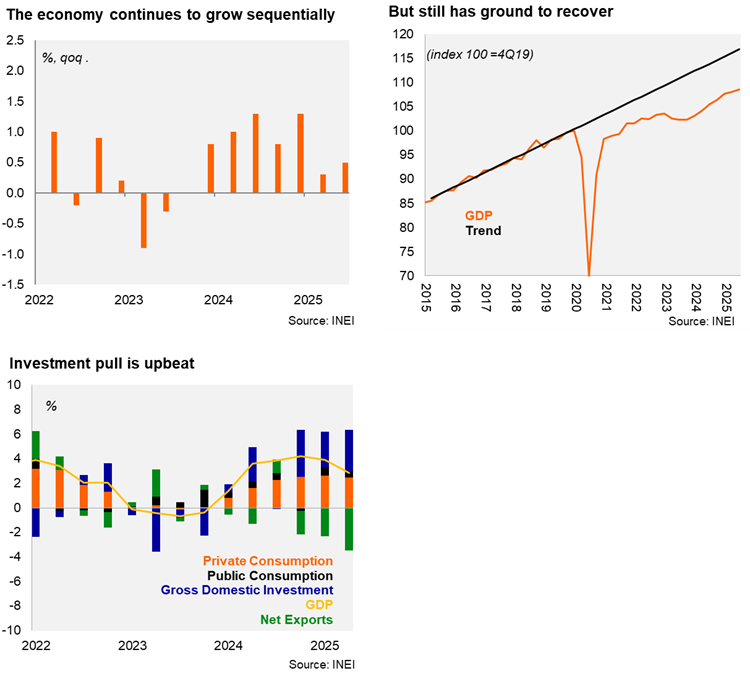

On a sequential basis, GDP grew by 0.5% QoQ/SA in 2Q25, up from 0.3% QoQ/SA in 1Q. The main drivers were gross capital formation (4.5% QoQ/SA) and private consumption (0.7% QoQ/SA), while exports were a drag (-4.6% QoQ/SA). Based on the latest data, if GDP remains at 2Q25 levels for the remainder of the year, 2025 annual growth would reach 2.4%.

Our take: Economic activity continues to perform well. Business confidence indicators remain broadly positive, the investment recovery is ongoing, and terms of trade are still near historical highs. We have a GDP growth forecast of 2.9% for 2025 and 2.7% for 2026. While tariff-related uncertainty presents medium-term downside risks, the slightly improved growth outlook for China and the exemption of refined copper exports to the U.S. will help mitigate short-term risks to Peru’s economic activity.