2025/10/15 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

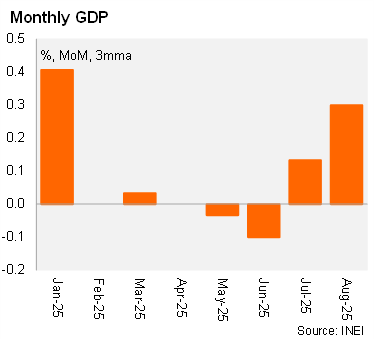

Peru’s economic activity, as measured by the monthly GDP proxy, expanded by 3.2% YoY in August, slightly above Bloomberg’s market consensus (3.1%). On a seasonally adjusted basis, activity increased by 0.3% month-over-month (MoM), following a 0.9% MoM rise in July. If activity remains at August levels through the end of the year, annual GDP growth would be approximately 2.2%.

Primary sectors showed mixed dynamics. Mining grew by 0.8% MoM, building on the 2.5% expansion in July. In contrast, fishing contracted by 18%, reflecting lower species catch and the continued enforcement of the ban in the North-Central zone of the Peruvian coast. Agriculture also declined, falling by 0.55% MoM.

Secondary sectors posted a heterogeneous performance. Manufacturing fell by 1.5% MoM, partially offsetting the 2.7% increase in July. Electricity generation decreased by 0.8% MoM, while construction rose by 0.5%, indicating a modest recovery.

Tertiary sectors contributed positively to overall activity. Restaurants and hotels expanded by 1% MoM, commerce grew by 1.1%, and transport registered a slight increase of 0.1%.

Our take: Economic momentum remains positive. Activity is consolidating around its potential. We forecast 2025 GDP growth at 3%. Private sector sentiment continues to be positive, supported by lower average inflation, declining borrowing costs, and expectations of a mining-led investment rebound. The recently approved pension fund withdrawal for roughly 2.5% of GDP may provide marginal support to private consumption by year end and into 2026, although we anticipate that most withdrawals should be saved. For next year, we maintained our GDP growth forecast at 2.7%. Political uncertainty as the 2026 elections approach, along with the lingering security crisis, are headwinds for economic activity.