2026/02/02 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

Consumer prices rose by 0.1% from December to January, essentially in line with Bloomberg's expectations and above the ten-year average for January. The monthly increase was primarily driven by restaurants and hotels, as well as rebounding food prices, yet offset by the normalization of seasonal travel demand after the holiday season, which led to a decrease in transport tariffs. Core inflation, which excludes volatile food and energy components, rose slightly by 0.04% month over month.

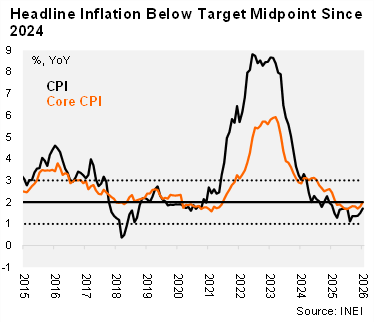

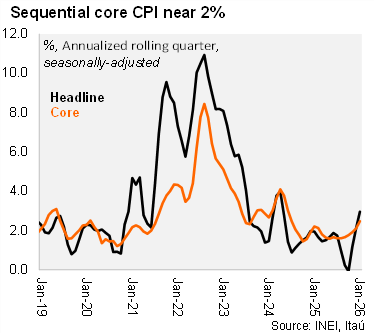

Sequential price pressures remain contained. Headline inflation on an annual basis increased by 20 basis points to 1.71%, remaining below the midpoint of the Central Bank’s target range of 2% ± 1.0% since November 2024. Sequentially, headline inflation reached 3% QoQ/SAAR. Core inflation rose by another 20 basis points to 2% year over year and sequentially rose 2.5% QoQ/SAAR. Importantly, survey-based one-year inflation expectations have remained anchored within the target range since December 2023, standing at 2.1% in December.

Our take: We expect inflation to gradually edge up in 2026 and converge toward 2%, the center of the BCRP’s target range, while inflation expectations remain firmly anchored. We anticipate a 0.20% rise in inflation in February. We believe the Central Bank is now in the fine-tuning stage of the cycle and that the BCRP is likely to hold the policy rate at 4.25% next week.