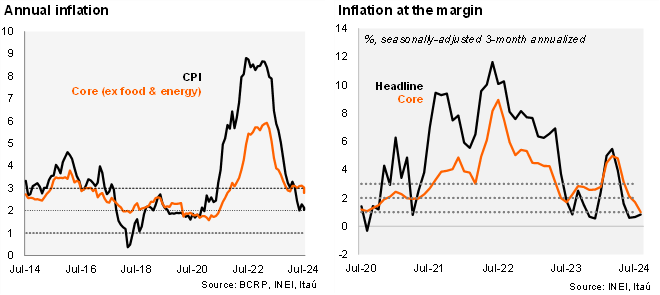

CPI increased 0.28% MoM in August (from 0.38% a year ago), slightly above market expectations of 0.22% (as per Bloomberg), yet below our forecast of 0.35%. The food and beverage division rose by 0.93% MoM, contributing to 23-bps, while restaurants and hotels increased by 0.22% and contributed 4-bp, contributing most to the headline rise. Core inflation (excluding energy and food items) stood at 0.01% MoM (from 0.24% a year ago). On an annual basis, headline inflation fell again to 2.03% YoY (from 2.13% in July, and 5.58% in August 2023), essentially reaching the central bank's target range (2+/-1%), while core inflation fell slightly to 2.78% (from 3.01% in July, and 3.81% in August 2023). At the margin, our seasonally adjusted three-month annualized CPI estimate came in at 0.83% in August (0.59% in 2Q24), while core inflation stood at 1.0% in the quarter (from 2.12% in 2Q24).

Our take: Even though headline inflation was somewhat above market expectations, core inflation fell within the BCRP’s target band for the first time since January. Given the emphasis that the BCRP statements have given to core inflation (“The Board is particularly attentive to new information on inflation and its determinants, including the evolution of core inflation [..] to consider, if necessary, additional changes in the monetary stance.”), we believe that the central bank will cut in the September meeting (September 12) to 5.25%, also responding to below trend economic activity (although recovering) and headline inflation within the target range for five consecutive months. We expect the BCRP to end the year at 5.00%.