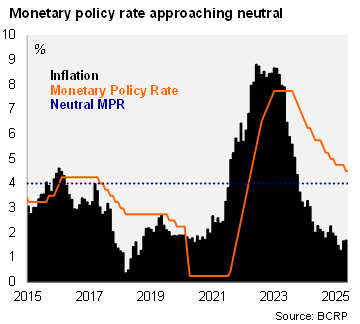

At its monthly monetary policy meeting, the Central Bank of Peru (BCRP) maintained its policy rate at 4.5%, in line with our expectations and the Bloomberg consensus. The guidance remained data-dependent, offering no clear indication of the next policy move. Notably, the BCRP’s communiqué removed the reference to the policy rate approaching neutral.

Despite the recent de-escalation in global risks, the communiqué conveyed continued concern about the external environment. It highlighted a slower convergence of inflation toward target levels across several economies and a more subdued outlook for global economic activity, amid persistent uncertainty and restrictive trade measures. In this context, the BCRP acknowledged ongoing volatility in global financial markets and a deterioration in global growth prospects.

On the domestic front, the Board noted an expected uptick in inflation, while inflation expectations remained stable and comfortably within the 1–3% target range. Twelve-month inflation expectations declined slightly to 2.27% in May, bringing the one-year ex-ante real interest rate to 2.23%, edging closer to the estimated 2.0% neutral real rate. Although activity indicators weakened somewhat compared to the previous month, they remained optimistic, with activity hovering around potential.

Our take: With the policy rate close to neutral, the central bank is in a better position to address the effects of heightened global policy uncertainty. Given that inflationary pressures remain contained, we see room for at least one additional 25 bp rate cut this year. We expect the easing cycle to conclude at 4.0% in early 2026. The next monetary policy meeting is scheduled for July 10.