2025/11/14 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

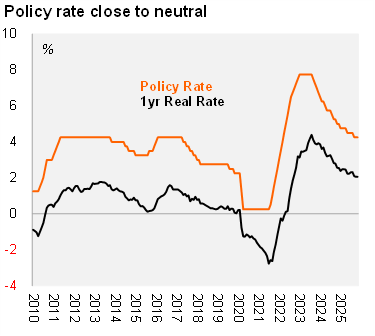

At its November monetary policy meeting the Central Bank of Peru (BCRP) kept the benchmark interest rate at 4.25% for the second consecutive month, in line with the broad consensus and our call. Forward guidance remained data dependent. Notably, the statement again omitted the reference indicating that the policy rate was very close to its estimated real neutral level. The ex-ante real interest rate remains stable at 2.1%, only marginally above the estimated neutral rate of 2.0%.

The BCRP reiterated its positive inflation outlook and maintained that economic activity remains close to potential. The assessment of domestic conditions improved slightly, supported by a gradual recovery in business sentiment. The statement highlighted the medium-term downside risks to global growth.

Although not present in the statement, the BCRP has recently purchased dollars. Given favorable foreign exchange market dynamics, the BCRP recently started to intervene, buying dollars to lean against the wind of fast sol appreciation (10% YTD).

Our Take: We expect headline inflation to rise moderately in the coming months reaching 1.6% by year-end. The balance of risks remains tilted to the downside, particularly if favorable exchange rate dynamics and low oil prices persist. We believe the Central Bank will cut the policy rate by 25-bps in December, ending the cycle at the nominal neutral rate of 4%. However, with the output gap largely closed, the policy stance only slightly contractionary, the BCRP may delay the final cut into 2026. The next monetary policy meeting is scheduled for December 11, and the inflation report is likely to be released shortly thereafter.