At its July monthly monetary policy meeting, the Central Reserve Bank of Peru (BCRP) kept its policy rate unchanged at 4.5%, in line with our forecast and Bloomberg consensus. The policy guidance remained data-dependent, offering no clear signal regarding the next move. The statement saw minimal adjustments, with the inflation risk balance unchanged.

The BCRP reiterated its concerns about the external environment, marked by a slower convergence of inflation toward target levels in several economies and a more subdued global economic outlook amid persistent uncertainty and restrictive trade measures. In this context, the BCRP acknowledged ongoing volatility in global financial markets and a deterioration in global growth prospects.

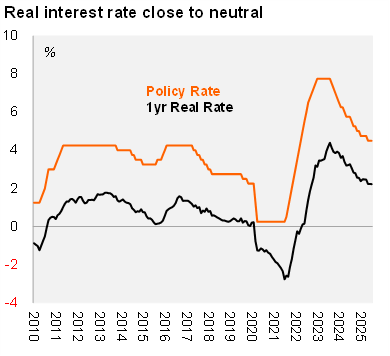

On the domestic front, the Board continues to project that headline inflation will stay within the lower half of the target range in the coming months, before rising due to adverse base effects and eventually stabilizing at the midpoint of the target. Core inflation is expected to hover around the midpoint of the range over the policy horizon. Notably, twelve-month inflation expectations held steady at 2.28% in June, implying a one-year ex-ante real interest rate of 2.22%. This places the real rate marginally above the estimated neutral level of 2.0%, suggesting policy is slightly contractionary. Although activity indicators showed a slight weakening compared to the previous month, they continued to signal broadly positive momentum, with economic activity operating near its potential level.

Our take: The favorable inflation outlook, in the context of growth close to potential, supports our expectation that the central bank will stick to its plan to bring the policy rate to the neutral level of 4%. We forecast one additional 25 basis point rate cut this year, bringing the rate to 4.25%. Our base case is that this cut will take place in September, however, the timing remains conditional on the evolution of external conditions and increased clarity regarding the Federal Reserve’s policy trajectory. Given that the current monetary stance is only marginally restrictive, the BCRP is under no immediate pressure to ease further. The next monetary policy meeting is scheduled for August 14.