2025/09/12 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

At its September monetary policy meeting, the Central Reserve Bank of Peru (BCRP) cut the policy rate by 25 basis points to 4.25%, following three consecutive months at 4.5%. Market expectations were divided between a hold and a 25 bp cut, with a slight majority favoring the latter.

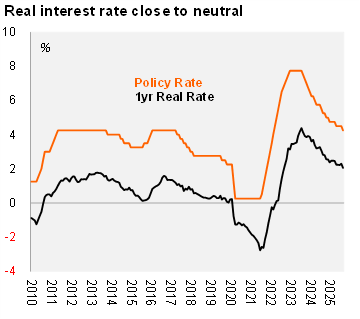

The policy guidance remained data-dependent, offering no clear signal regarding the next move, though the BCRP noted it is “close to neutral.” The statement saw minimal changes, with the inflation risk balance remaining unchanged. The ex-ante real rate now stands at 2.07%, only slightly above the estimated neutral real rate of 2.0%.

The BCRP reiterated its concerns about the external environment, particularly the persistence of restrictive measures on foreign trade. However, the Board now views these risks as tilted to the downside only over the medium term, rather than over an indefinite horizon as previously stated. On the domestic front, the Board maintained its benign view of inflation and continues to project it will stabilize at the midpoint of the target range by year-end. The Board maintains its assessment that domestic economic activity remains near potential.

Our take: The favorable inflation outlook, combined with growth near potential, supports our view that the Central Bank will continue moving toward a neutral policy rate of 4.0%. We expect one more 25 bp rate cut this year, bringing the policy rate to 4.0% by year-end. Global developments remain a key factor for the medium-term outlook and the BCRP’s policy response. The next monetary policy meeting is scheduled for October 9.