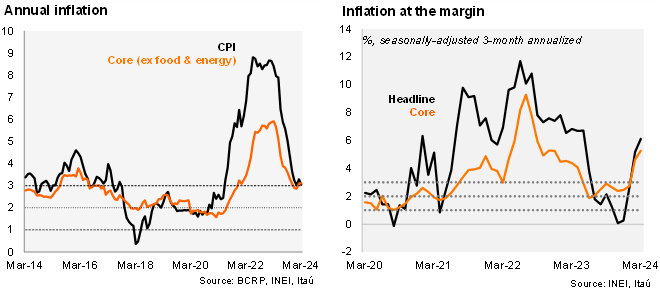

CPI rose by 1.01% MoM in March (from 1.25% a year ago), above our 0.62% forecast and market consensus of 0.76% (as per Bloomberg). Upside pressure came from food prices (contribution to headline inflation of 42-bp) and a seasonal increase in education prices (contribution of 36-bp). Core inflation (excluding energy and food items) stood at 0.88% MoM (practically unchanged from a year ago). On an annual basis, headline inflation fell to 3.05% YoY in March (from 3.29% in February), while core inflation stood at 3.11% (practically unchanged from the previous month). At the margin, the seasonally adjusted three-month annualized CPI came in at 6.12% in March (from 5.18% in February), while core inflation stood at 5.27% (from 4.64%).

Our take: While headline inflation surprised to the upside for the second consecutive month, both - headline and core inflation are stable and remain slightly above the upper bound of the central bank target (2+-1%) which is unlikely to turn the central bank hawkish (we also note that inflation expectations are inside the target range). In our view, the pause in the easing cycle is a response to avoid pressure on the exchange rate, as a consequence of the narrowing of the rate differential. We think that once the Fed begins easing, likely in June, the BCRP is likely to resume its easing cycle. Our end of year policy rate stands at 5.25%.