2025/12/01 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

Consumer prices rose by 0.1% from October to November, coming in below both the Bloomberg consensus (0.19%) and our forecast (0.20%). This marks the fourth consecutive downside surprise. Higher prices in food (0.41% m/m), transport (0.18% m/m), and restaurants & hotels (0.19% m/m) were offset by lower prices in accommodation, water, electricity, gas, and other fuels (-0.37% m/m). Core inflation, which excludes volatile food and energy components, rose by only 0.06% month-over-month.

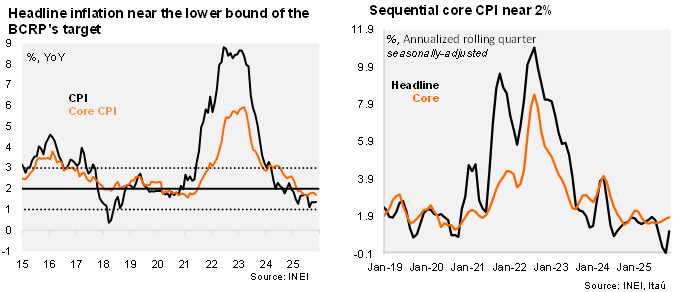

Sequential price pressures remain contained. Headline inflation on an annual basis rose by 2 basis points to 1.37%, staying below the midpoint of the central bank’s target range of 2% ± 1.0% since November 2024. Sequentially, headline inflation was 1.1% QoQ/SAAR annualized. Core inflation fell slightly to 1.7% year-over-year, close to a four-year low, and sequentially reached a similar rate of 1.9% QoQ/SAAR. Importantly, survey-based one-year inflation expectations have remained anchored within the target range since December 2023, reaching 2.2% in October.

Our Take: We expect headline inflation to rise moderately in December, partly due to base effects, reaching 1.6% YoY. The balance of risks remains somewhat tilted to the downside. For 2026, we anticipate inflation will gradually rise toward the BCRP’s 2% inflation target. Favorable exchange rate dynamics and low oil prices place a downside risk to our call. Given the benign inflation outlook, we anticipate one final 25-bp rate cut, bringing the policy rate to a neutral 4%. With the output gap largely closed and inflation expectations anchored, there is limited need to extend monetary policy into expansionary territory. The December inflation print will be released on January 1, and we preliminarily forecast a 0.3% month-over-month increase.