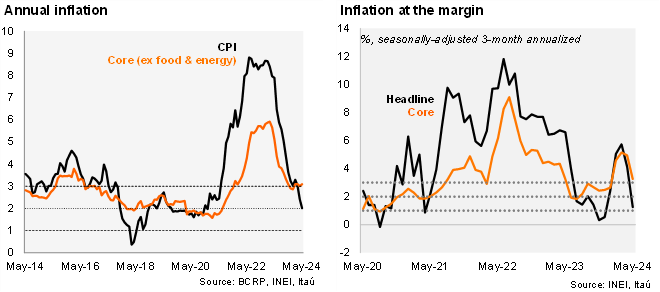

CPI fell by 0.09% MoM in May (from 0.32% a year ago), below our forecast of +0.28% and market expectations of +0.12% (as per Bloomberg). As in the previous downside surprise (April), the main drag to the headline inflation figure came from food prices (a negative contribution of 20 bp) which was mitigated by the other subindexes. Core inflation (excluding energy and food items) stood at 0.16% MoM (from 0.08% a year ago). On an annual basis, headline inflation fell to 2.00% YoY in May (from 2.42% in April), while core inflation stood at 3.10% (from 3.01%). At the margin, the seasonally adjusted three-month annualized CPI came in at 1.26% in May (from 4.12% in April), while core inflation stood at 3.26% (from 4.94%).

Our take: A fragile activity recovery and well-behaved inflation supports further rate cuts (from the current level of 5.75%). While the narrowing of the BCRP-Fed rate differential suggest further rate cuts are limited, recent comments from the President of the central bank, suggesting the policy rate could go below the Fed policy rate, increased the odds of further monetary easing, in addition to cuts to the reserve requirement ratio.