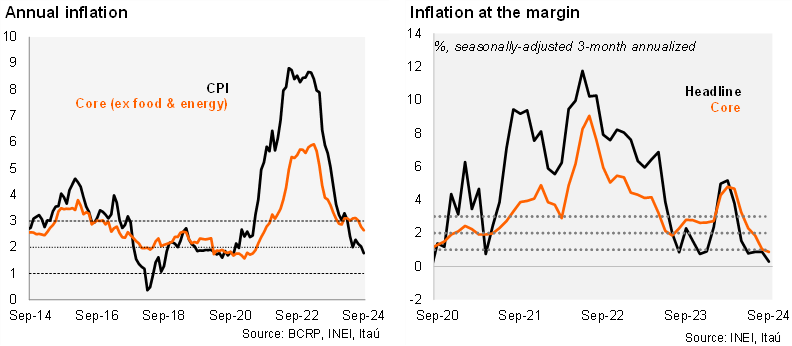

Following the monthly 0.28% rise in August, inflation unexpectedly fell by 0.24% MoM in September (from +0.02% a year ago), well below market expectations of a 0.08% increase. The monthly decline in September was mainly driven by large declines in volatile food items, that led to a fall in the food and non-alcoholic beverage category, roughly 23% of the CPI basket, of 0.97% MoM. On an annual basis inflation fell to 1.78%, falling below the center of the 2+/-1% target, and the lowest since October 2020. Core inflation (ex-food & energy) was flat monthly, which led to another annual fall to 2.64%.

At the margin, our seasonally adjusted three-month annualized CPI estimate came in at 0.28% in September (0.59% in 2Q24), while core inflation stood at 0.87% in the quarter (from 2.12% in 2Q24).

Our take: The disinflation process continues, supported in September by an unexpected decline in volatile food staples that is likely to revert. Given the emphasis that the BCRP statements have given to core inflation (“The Board is particularly attentive to new information on inflation and its determinants, including the evolution of core inflation [..] to consider, if necessary, additional changes in the monetary stance.”), we believe that the central bank will continue easing this year to 5.0%, with risks leaning towards more cuts and faster decline next year to neutral (4.0%).