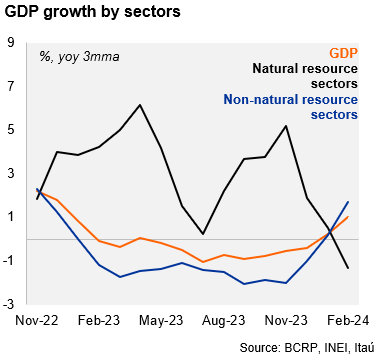

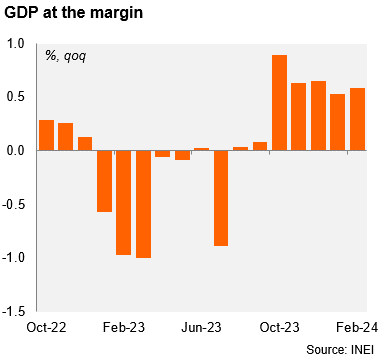

The monthly GDP proxy increased 2.9% YoY in February (from 1.4% in January), above our forecast of 1.8% and market expectation of 2.1% (as per Bloomberg). We note monthly activity was partly boosted by a favorable base effect, on an annual basis, as social conflicts affected activity in 1Q23. The headline figure was driven by a strong expansion in mining (15.9% YoY in February) and construction (6.4%), while fishing and agricultural sectors fell by 31.3% and 2.0%, respectively. Services continues in recovery mode, increasing 2.4% YoY in February compared to 1.5% in January but still below the 10-year average of 3.2%. Still, momentum remained soft, with the quarterly annual rate of the monthly GDP at 1.0% February. Using official seasonally adjusted series, the monthly GDP increased 1.2% MoM/SA in February, taking the quarter over quarter (non-annualized) growth rate to 0.6% in February (from 0.5% in 4Q23).

Our take: Our GDP growth forecast for 2024 stands at 2.5%. While today’s activity figure was above market expectations, momentum remains soft. In this line, the BCRP concerns on activity should not change significatively after this figure, suggesting further easing of the monetary policy stance is likely amid well behaved inflation. However, we note that cuts in the reserve requirement (to ease financial conditions) are more likely than rate cuts in the policy rate given the narrowing of the rate differential with the Fed which could pressure the currency. Our end of year policy rate estimate is at 5.75%, which implies one more rate cut of 25-bp during the rest of the year.

Julio Ruiz