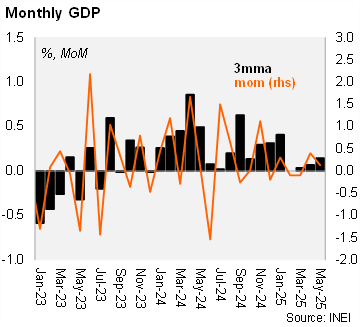

Peru’s monthly real GDP proxy grew by 2.7% year-over-year (YoY) in May, significantly above the Bloomberg market consensus of 2.1% YoY. On a seasonally adjusted basis, activity rose by 0.1% MoM, building on the 0.4% MoM gain in April. If the economy maintains May levels through the year end, annual GDP growth would come in at 2.2% (3.3% in 2024).

The May print was primarily driven by strong performance in the agriculture sector (+12% MoM/SA; contribution: +0.72 percentage points) and services, particularly segments that benefited from Mother’s Day-related spending. The construction sector also expanded by 2.8% MoM/SA. In contrast, mining contracted by a sharp 8.9% MoM/SA, while manufacturing declined by 1.8% MoM/SA.

Economic momentum remains positive, rising by 0.7% quarter-over-quarter (QoQ/SA) in the rolling quarter ending in May, up from 0.1% in Q1.

In parallel, the unemployment rate rose to 6.4% in June from 5.6% in May, exceeding the estimated NAIRU of 5%. The labor force participation rate stood at 64.1%, down 2.1% compared to the same quarter in 2024, while employment posted a mild 0.4% increase year-over-year.

Our Take: We expect GDP growth of 2.9%. Given the relatively inelastic nature of copper demand (with average elasticity estimates ranging from -0.3 to -0.4), any decline in U.S. imports is expected to be gradual. For 2026, we project a slight moderation in GDP growth to 2.7%, amid expectations of a global economic slowdown. Terms of trade are expected to remain favorable, and the current account is projected to post a surplus of 1.2% of GDP this year. We forecast an additional 25 basis point rate cut this year to 4.25%, while close attention will need to be paid to labor market developments.