2025/08/18 | Andrés Pérez M., Vittorio Peretti, Andrea Tellechea & Ignacio Martínez

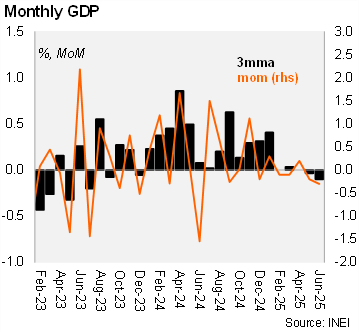

Peru’s monthly GDP proxy expanded by 4.5% year-over-year (YoY) in June, undershooting the Bloomberg market consensus of 4.8% YoY. On a seasonally adjusted basis, activity contracted by 0.2% month-over-month (MoM/SA), following a 0.3% decline in May. Since December 2024, monthly growth has averaged just 0.1%, reflecting a level of stagnation. If activity remains at June levels through year-end, annual GDP growth would reach approximately 2.3%, down from 3.3% in 2024.

In June, Primary sectors posted mixed results. Mining expanded by 4.2% MoM (SA) but was offset by sharp contractions in fishing (-13.9% MoM) and agriculture (-1.1% MoM). Secondary sectors remained subdued, with manufacturing falling 2.7% MoM (SA), and construction and electricity generation showing marginal growth. Service sectors were mixed. The normalization of demand following May’s Mother's Day surge led to notable declines in restaurants & hotels (-10.3% MoM7SA) and transport (-0.4% MoM/SA). Increases in telecommunications (+2.8% MoM/SA) and commerce (+0.2% MoM/SA) partly offset the weaker overall dynamics.

Our take: We expect downside risks to mining activity from the ongoing protests in southern regions over the coming months that could risk of 2.9% GDP growth call for this year. The benign inflation outlook, along with near potential economic growth supports our view that the Central Bank will continue its path toward a neutral policy rate of 4%. The 2Q GDP is scheduled for August 22.