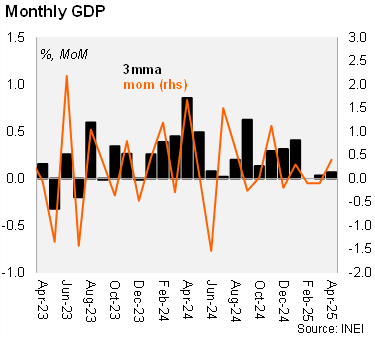

The monthly real GDP proxy rose by 1.4% YoY in April, below the consensus of 2% YoY. Sequentially, the activity rebounded by 0.4% MoM/sa, up from -0.1% in the previous month. This sequential improvement comes after a period of subdued growth, with monthly gains averaging just 0.1% MoM/sa since December 2024. On annual basis, the seasonally adjusted series points to a 1.5% YoY/sa expansion. The April print was primarily driven by strength in the services sector, particularly those segments benefiting from seasonal Holy Week demand. In contrast, the primary and secondary sectors were mixed.

Activity momentum remains positive but is decelerating. The statistical carryover for Q2 2025 stands at 0.5% QoQ/sa, down from 0.7% in Q1. For the full year, the carryover effect is estimated at 2.6%.

Out take: We expect some payback in May following the normalization of seasonal demand. We added an upward bias to our 2.8% GDP forecast for 2025, supported by the investment recovery, a robust labor market, and positive terms of trade, among others. The potential approval of another pension fund withdrawal this year could boost private consumption in the short term, at the cost of further eroding domestic savings. Domestic policy uncertainty may rise as presidential and legislative elections approach. Additionally, uncertainty regarding global trade tensions could impact private sentiment and slow the pace of the activity recovery next year, which we project at 2.7%.