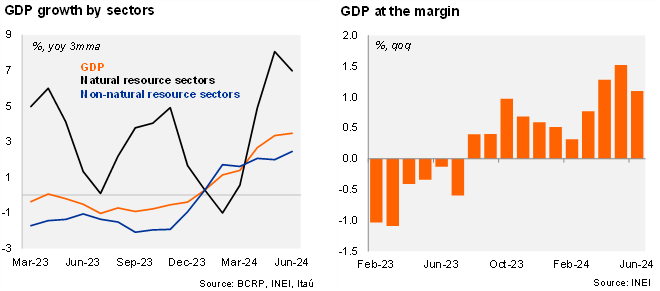

The monthly GDP proxy increased 0.2% YoY in June (down from 5.0% in May), below market consensus of 1.8% (as per Bloomberg) and our call of 2.0%. The headline figure was dragged by mining output (-7.5% YoY in June, from 1.8% in May), the agricultural sector (-1.6%, from 2.6%) and construction (-2.4%, from 5.5%). On the other hand, services and commerce seem to be gaining momentum, expanding 3.7% YoY in June (from 2.3% in May) and 2.3% (from 2.1%), respectively. Overall, monthly GDP momentum remained positive, with the 2Q24 annual rate at 3.5% (from 1.4% in 1Q24), supported mainly by primary activity (7.0%), while non-primary activity improved to 2.5% (from 1.6%). Using official seasonally adjusted series, the monthly GDP fell by 1.5% MoM/SA in June (after a practically null expansion in May), taking the quarter over quarter (non-annualized) growth rate to 1.1% in 2Q24 (from 0.8% in 1Q24).

Our take: While activity momentum is positive (1.1% qoq/sa in 2Q24) and it is likely to continue recovering in the 2H of the year, the GDP recovery has been somewhat slower than expected. This suggests that the economy is unlikely to grow beyond our forecast for 2024 of 3.1%. In fact, our forecast has a downward bias. In this context, and amid well behaved inflation and high odds of the Fed starting its easing cycle in September, the BCRP is likely to continue cutting its policy rate by 25-bp during the rest of the year (our end of year policy rate is at 5.00%).